H.B. 346, Reorganization & Economic Development Act, sailed through three House committees, including Health, Insurance, and Rules, this week before passing 86-26 in the House Thursday and now heads to the Senate.

The bipartisan bill would allow Blue Cross Blue Shield North Carolina and Delta Dental to reorganize and create a holding company that could transfer billions in surplus policyholder money.

Rep. John Bradford, R-Mecklenburg, one of the bill’s primary co-sponsors, said various stakeholders got 90% of what they wanted as it passed through the House Health, Banking, and Rules committees, including amendments to the bill.

N.C. Insurance Commissioner Mike Causey, a Republican, voiced his opposition to the bill earlier this week, saying it lacked transparency and that healthcare premiums would likely rise as it allows BCBSNC to circumvent statutory limits on reserves that would otherwise require money to be returned to policyholders or reduce rates, which will more than likely raise rates for everyone with the company’s insurance.

Rep. Pricey Harrison, D-Guilford, echoed Causey’s concerns, stating that she was concerned about the bill since it was filed, calling it a “backdoor repeal of the public conversion statute that created the measures for establishing a conversion,” which she says would move the entire fair market value of the company to a charitable foundation for the benefit of North Carolina citizens.

A conversion would be triggered if the threshold for BCBSNC’s for-profit involvement is 40% of its total assets and 10% of assets in any transaction, as well as any other regulations.

“I will admit that I don’t understand the complexity of this bill,” Harrison added. “We’ll end up with increasing premiums on the 4.4 million North Carolinians who are currently subscribed to Blue Cross Blue Shield, and the possibility of premium rebates will be eliminated.”

She implored her colleagues to vote no because it had less than 10 minutes of public input, including only two minutes for Causey.

Rep. Abe Jones, D-Wake, asked members what effect it would have on their constituents if they passed a bill they truly don’t understand and advised voting against it.

“I’ve heard it said that the commissioner of insurance has the authority to review these investments and so forth, but when I asked the president of Blue Cross Blue Shield himself whether or not Commissioner Causey had the ability to stop what he perceived as risky investments, the answer was no,” said Rep. Deb Butler, D-New Hanover. “So, to me, that sends a red flag. When you’ve got a commissioner of insurance who does not support the bill and does not have the authority to stop what he perceives as the riskiest investments coming from this bill, that gives me great pause.”

Rep. Jason Saine, R-Lincoln, argued that North Carolina needs the bill because it will make it easier for companies to do business in the state.

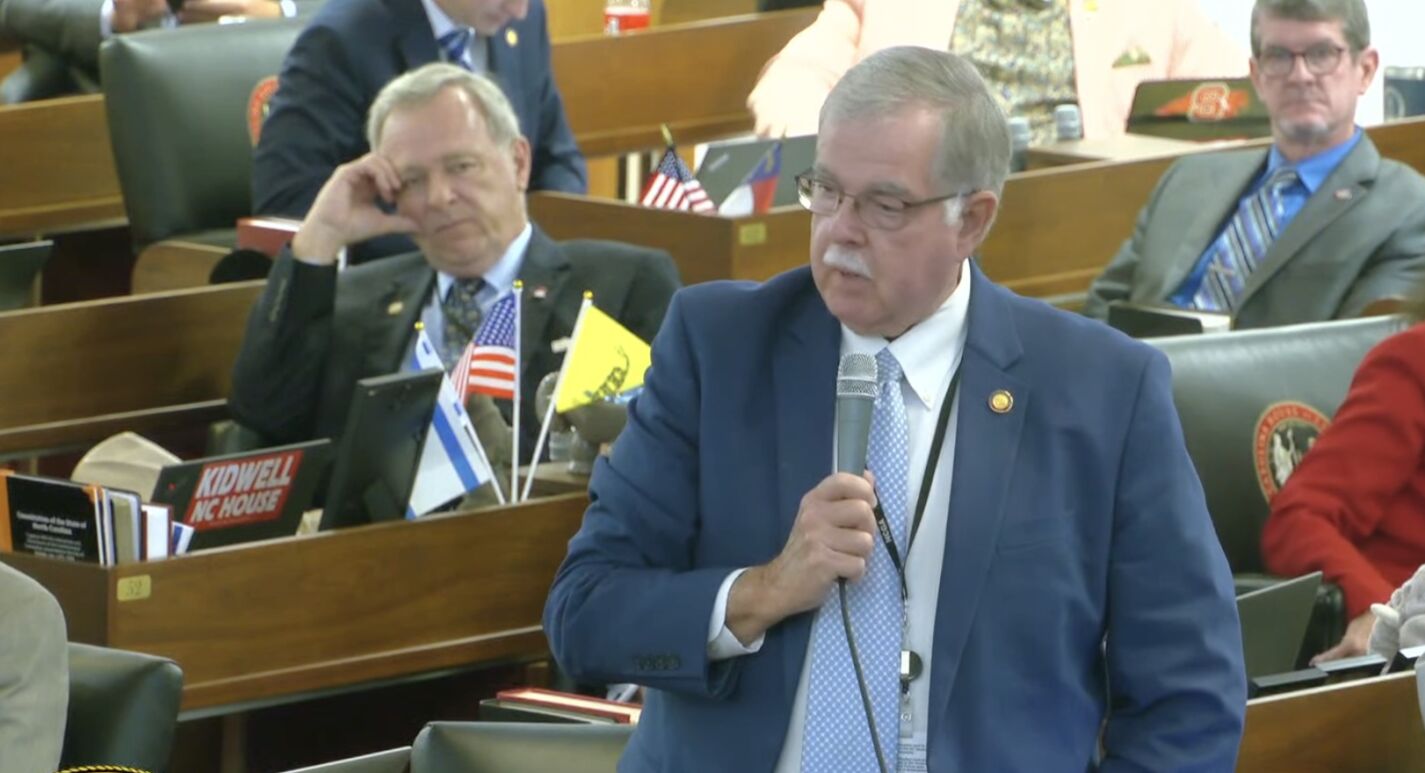

“The bill is very different from how it started and has incorporated many of the concerns expressed,” he said. “It protects the mission of the company; it adds transparency into the investments and salaries to the board and executives and ensures that the commissioner has authority to enforce protections added to the bill. It limits how much can be transferred in the restructuring to ensure that premiums won’t go up as a result of the transfer.”

“To have the sponsors on this bill that have supported this bill, to have the Majority Leader (Rep. John Bell, R-Wayne) and the Minority Leader (Robert Rieves, D-Chatham) ,on a bill as primary sponsors actually causes me to think hard about it and then they have two of the senior level finance chairs, and I quite frankly don’t believe they lead us down a bad path,” said Rep. Donny Lambeth, R-Forsyth.

He said, as he did in Wednesday’s House Insurance Committee meeting, he didn’t think health premiums would go up as a result of the bill, they might actually go down, but healthcare premiums could go up as a result of rising costs that have nothing to do with BCBSNC’s actions.

Bradford summed up the discussion by saying he has been available the entire time the bill has been out, and if anyone wanted to spend any time with him before today, they could have, and they can still talk with him after the vote.

“It’s important to know the conversion statute remains in place for the future, so the public trust money will still be there that’s in place,” he said. “I just want to make this very clear there is nothing in this bill that would increase premiums. “Opponents have not provided any concrete examples of how this would lead to higher premiums because the commissioner himself holds the authority to approve or deny premiums.”

Bradford said the authority is in the statute and if premiums go up, people should ask Causey because the bill doesn’t have an impact on that.

In an emailed statement to Carolina Journal, BCBSNC Spokeswoman Sara Lang said the company thanks House members and state leaders for their support of this bipartisan legislation that will improve the health and well-being of North Carolina and its communities.

“Throughout the legislative process, this bill has been improved to address concerns and includes significant guardrails to increase transparency and accountability,” she said. “The bill requires that Blue Cross NC remains true to its not-for-profit mission and commitment to North Carolina and that the Holding Company supports that mission.”