North Carolina revenue forecasts have surpassed $33 billion annually, and the state will have roughly $3.25 billion in excess for Fiscal Year 2022-23, or 10.7% more than had been previously budgeted.

“Today’s consensus revenue forecast confirms that North Carolina’s tax policies are fueling economic growth,” said Senate Leader Phil Berger, R-Rockingham. “The surplus is a significant increase over the current fiscal year’s budget.”

More individual and corporate income tax collections than expected, strong consumer spending, inflation, and higher interest rates contribute to the excess revenue, according to an email sent out to lawmakers by the Fiscal Research Division and the Office of State Budget and Management (O.S.B.M.).

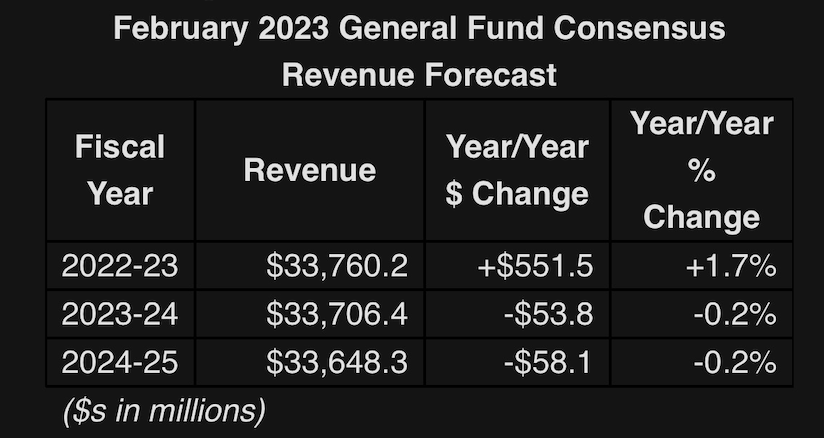

This table summarizes the forecast.

According to the email, reasons for anticipated overcollections include:

- Individual and corporate income tax collections year-to-date have been much stronger than anticipated.

- Consumer spending has remained strong despite continued inflationary pressures, boosting sales tax collections on goods and services through continued spending and higher prices.

- Investment income earned on the operating cash and reserves in the General Fund has exceeded expectations due to high fund balances and the overall higher interest rate environment.

“Although recession risks remain uncomfortably high, the economic outlook underlying this forecast assumes the economy will avoid an outright downturn but will experience what has recently been termed a “slow-cession”, whereby economic growth comes to a near standstill without slipping into reverse for any extended period,” Emma Turner, Ph.D. and Chief Economist of the Fiscal Research Division wrote in her email to lawmakers.

Despite the excess revenue, Berger cautioned against lawmakers jumping the gun on spending increases and called for more taxpayer relief.

“While this year’s surplus is welcomed news, we need to be cautious as we prepare the budget,” said Berger. “We must continue to prioritize responsible spending, addressing our state’s workforce needs, and providing additional tax relief to our citizens.”

Fiscal and O.S.B.M. are expected to revise their projections again in May depending on whether there is an “April Surprise.” April revenue may differ significantly from expectations due to recent policy changes, according to Turner.

“This forecast anticipates a period of stagnant growth to endure for a significant portion of 2023, followed by a period of slower-than-average growth over the remainder of the biennium,” said Turner. “Inflation is expected to slow compared to recent peaks while still remaining above the Federal Reserve’s 2% target well into 2024.”

Fiscal and O.S.B.M. plan to release more details on Friday, Feb. 17, 2023.

“Revenues for the current fiscal year are well ahead of the pace predicted in May of last year, a sign both of the sharp increase in newly-created money circulating through the economy and North Carolina’s low-tax environment,” said Brian Balfour of the John Locke Foundation. “Legislators would be wise to set aside most, if not all, of this surplus in anticipation of the upcoming economic downturn. Fiscal Research is projecting revenue to fall the next two years, meaning the state will need to rely on a healthy savings reserve to draw from in order to avoid tax increases to finance state government.”