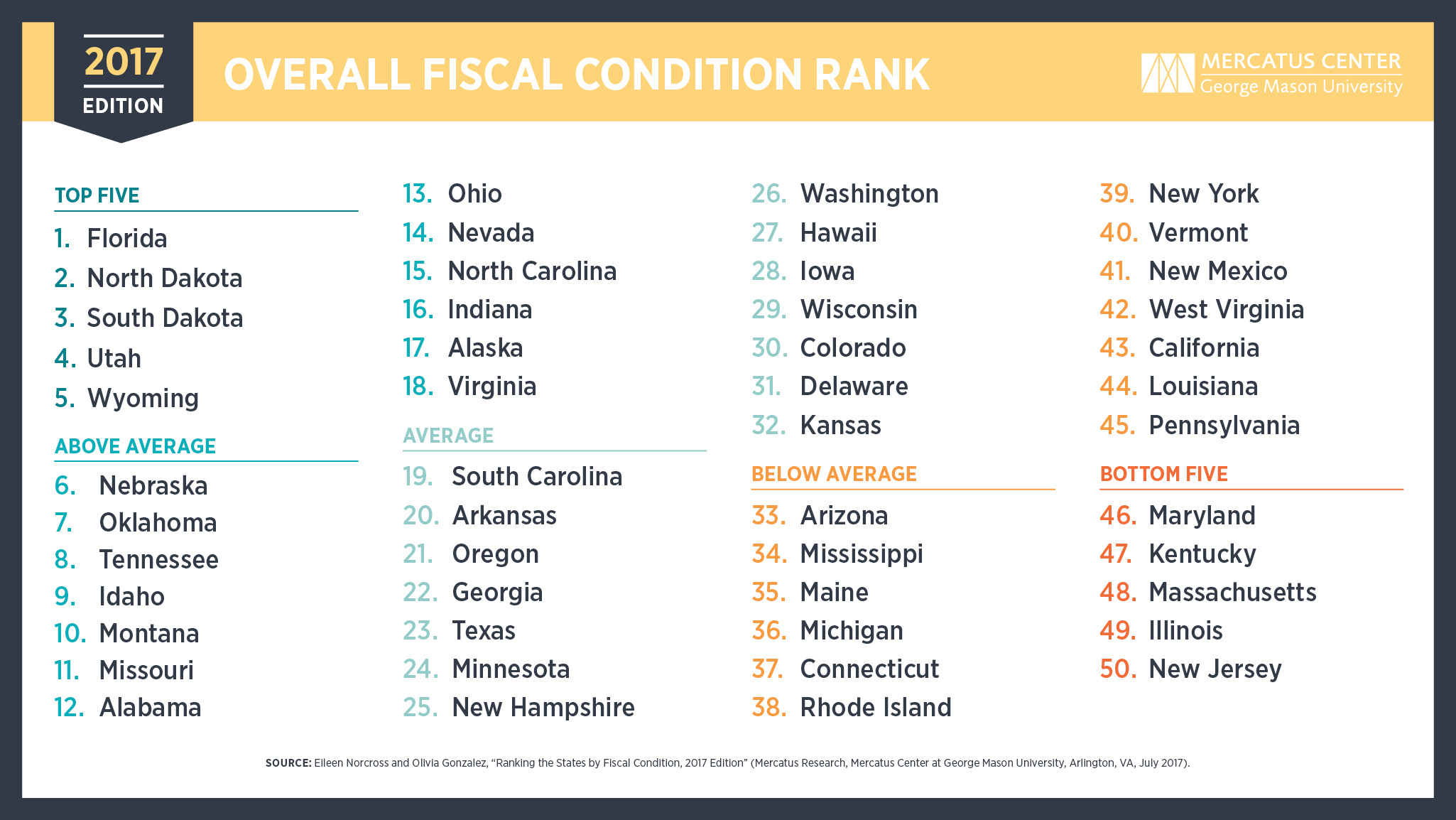

A new report ranking states’ fiscal health puts North Carolina 15th nationally, highlighting the Tar Heel State’s strong revenue and solid pension funding.

The report, published July 11 by the Mercatus Center at George Mason University, measured changes in the state’s financial stability from 2013 to 2015. The state moved up six slots, from 21st in the previous Mercatus rankings.

State Senate leader Phil Berger, R-Rockingham, attributed the state’s fiscal health to Republican legislative efforts.

“While some on the other side of the aisle are doing everything they can to discredit our conservative budgeting approach of spending restraint and middle-class tax relief, the data speaks for itself,” Berger said.

By category, North Carolina’s best standing was in budget solvency. It ranked fifth in its ability to cover year-to-year costs with current revenues. The report said that state revenues exceed budget expenses by 12 percent.

Joe Coletti, senior fellow at the John Locke Foundation, attributed North Carolina’s financial health to conservative fiscal policy.

“The simple story is that the General Assembly has restrained the growth of government and set aside much of the surplus in the savings reserve,” Coletti analyzed. “Restraint like this was rare in North Carolina between 2001 and 2011, and is still uncommon across states, as seen in Illinois, New Jersey, and even Kansas and Oklahoma.”

Researchers found only a little bad news about the state’s fiscal solvency. The state’s worst ranking was in cash solvency, measuring the ability to pay short-term debts, at 29th.

“On a short run basis, North Carolina has between 1.28 and 2.46 times the cash needed to cover short-term obligations, which is the state’s only metric that is worse than the national average,” the report noted.

Coletti said some states near the top of the list for cash solvency are dependent on natural resources. This gives them an advantage when commodity prices are high, but Coletti expects North Carolina will improve in the rankings as reserves grow.

The state debt ranked low, at $815 million, which comes out to $846 per person.

The state’s long-run forecast is “significantly improved,” and “stronger than the average for the states.” By one measure, the state’s liabilities were only one fourth the size of those held by others.

Coletti said that not all of the current tax reforms had taken effect in 2015, the last year included in the study, so he said the state’s service-level solvency should continue to improve.

Connect NC bonds could hurt the state’s Mercatus rankings when they go into effect, but Coletti also noted the state has improved from 27th to 15th best on the list overall in the past two years.