Recently, Kim Mackey, a Wake County social-studies teacher, put together a website called N.C. Teacher Tax, which calculates how much money teachers lose to inflation compared to the pay they “signed up for” when they started. Teachers are certainly feeling the effects of rising prices, but the experience of inflation eating away at one’s buying power is hardly unique to them.

Mackey is a frequent author for left-wing North Carolina political sites like Cardinal & Pine, N.C. Policy Watch, and the editorial pages of the News & Observer. She is also a leader for the N.C. Association of Educators (the state’s NEA teachers union affiliate) and a former advisory board member of the protest group Red4Ed. So she certainly comes with a certain perspective on education.

But news sites were happy to run with her new N.C. Teacher Tax calculator and to publish it as if she were just an everyday teacher who happened to come across some interesting data on teacher pay and inflation.

WUNC, a state-based NPR affiliate, ran a piece with the title, “State teacher pay hasn’t kept pace with inflation. Teachers call it the ‘NC teacher tax.'” The lede read, “Social studies teacher Kim Mackey, who teaches at Green Hope High in Wake County, isn’t afraid to do a little math.” They never mention her affiliation with NCAE, Red4Ed, N.C. Policy Watch, Cardinal & Pine or other left-wing activism around education.

Neither did CBS-17 in their news segment on the new tool, seen below:

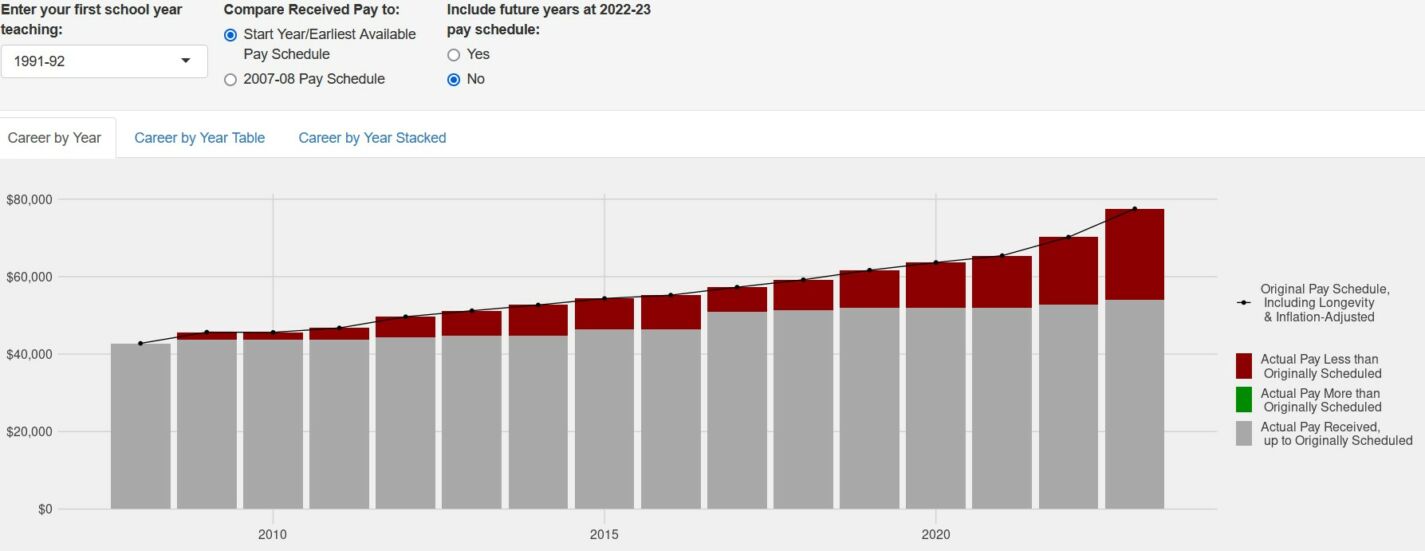

Looking at Mackey’s site, which was designed by a fellow teacher, the sample data shows that if a teacher started 22 years ago, inflation would have taken a chunk out of their buying power. Although, unless I’m misreading things, the chart seems to put the “actual pay received” for a 22-year teacher at about $55,000, which does not seem to line up with the total compensation with step increases, local supplements, and generous benefits typically received by veteran teachers. Not being an education-policy expert myself, I’ll leave that for others to judge.

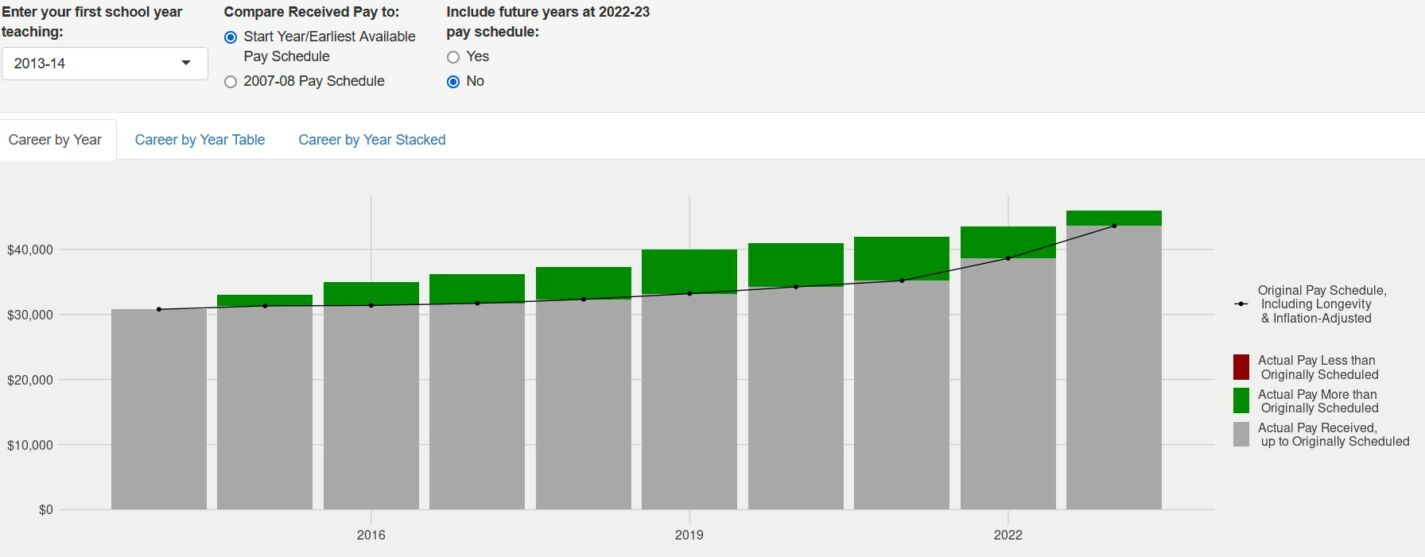

Even accepting these calculations, it doesn’t take much poking around using the tool to see that those who have been teachers for fewer years have not had to deal with inflation much, if at all.

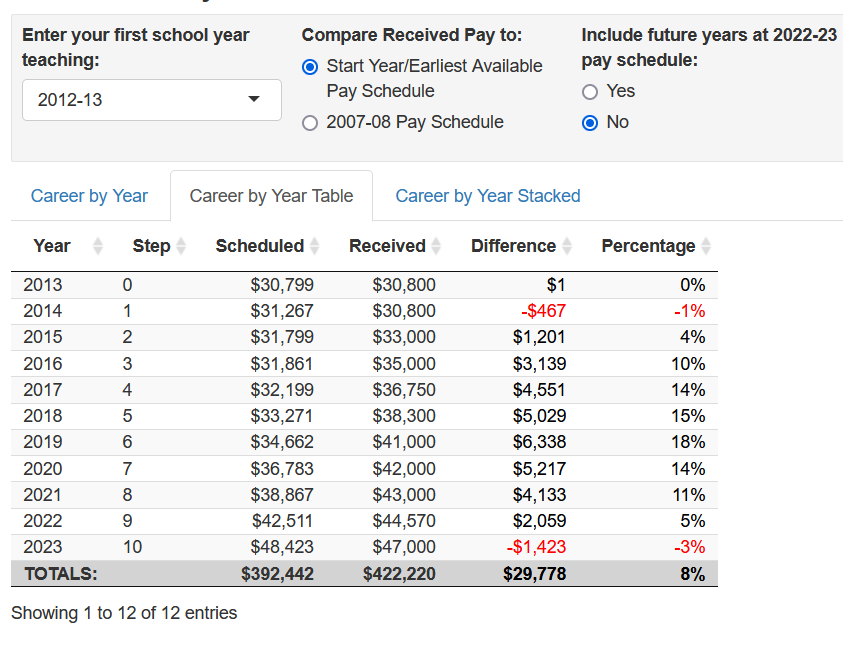

For example, if you plug in 2013 as the starting date, for those teachers who have been in the profession 10 years, one sees no red for inflation. In fact, there is green, meaning they saw more wages than they “signed up for.”

Instead of a “teacher tax,” they saw a “teacher bump” due to frequent bonuses from the Republican General Assembly — almost $30,000 worth.

With inflation hitting particularly hard since COVID-19 stimulus spending, it looks like state legislators are poised to respond with a larger-than-usual salary increase. According to Carolina Journal’s statehouse reporter Alex Baltzegar, the proposed N.C. House budget would make teacher pay in the state the highest in the region.

At that new average pay, the red of inflation would recede from this tool for even the most veteran teachers, and, I’d imagine, almost everyone would see their wage increases beating inflation.

Not everyone is so lucky

But inflation is not just a tax on N.C. teachers. It’s a tax on all workers. And ironically, it’s largely due to these kinds of budget debates, where legislators (this time at the federal level) are pressured to spend more and more until the debt weakens the dollar. There are of course other causes of inflation, like low productivity and easy credit.

Americans, including those here in North Carolina, are experiencing serious inflation, likely for a combination of all these reasons. And, while wages have been rising, most workers have not been fortunate enough to be able to see their wages surpass the rate of inflation.

Government data from late last year showed that while inflation had gone up over 7%, wages had only increased by 4.5%. This means, like teachers, most workers have been getting raises, but the red inflation bar is, on average, higher than the purchasing power they signed up to receive.

Kim Mackey is right. Inflation is a tax on income. Employees should be furious and should lobby elected leaders to control this hidden tax. Thankfully for her, teachers are in a better position to hold onto their purchasing power as inflation continues to affect us all.