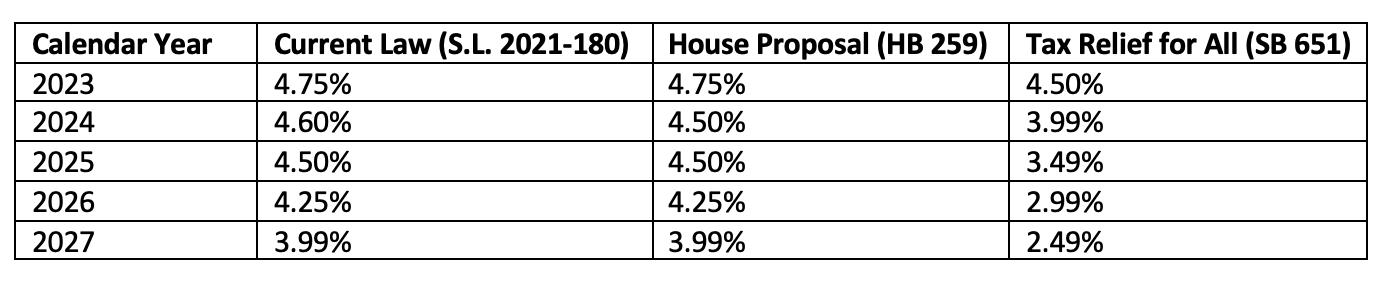

- The new proposed tax cut schedule would lower the personal income tax rate to 2.49% after 2026.

On Wednesday, Senate Leader Phil Berger, R-Rockingham, and Senate Finance Committee chairs Sens. Bill Rabon, R-Brunswick, and Paul Newton, R-Cabarrus, filed legislation to cut North Carolina’s personal income tax rate to below 2.5% by 2026.

Senate Bill 651, also known as “Tax Relief For All,” is the Senate’s latest measure to alleviate the tax burden on all residents of North Carolina, building on their previous efforts to reduce taxes. While the state budget passed last year included scheduled tax reductions, this new proposal goes further by expediting the timeline and further reducing tax rates.

Specifically, Senate Bill 651 seeks to lower the personal income tax rate in the following manner:

- In 2023

4.75%4.5% - In 2024

4.6%3.99% - In 2025

4.5%3.49% - In 2026

4.25%2.99% - After 2026

3.99%2.49%

“Money belongs to the people who earn it,” said Paige Terryberry, Senior Fiscal Policy Analyst at the John Locke Foundation. “These aggressive proposed cuts to the state’s personal income tax rate are a positive signal to North Carolinians who will keep more of their earned income. This would also be a huge win for small businesses.”

The Senate’s approach is more aggressive than the personal income tax cuts unveiled in the NC House budget proposal last week. Under the House proposal, the rate would decrease to 4.5% one year earlier than scheduled.

Governor Roy Cooper has been vocal in his opposition to the tax cuts implemented by the Republican-led legislature since he took office. This year, however, he has escalated his criticism by proposing tax hikes in his budget proposal.

“Republicans in the Senate have a different idea than Democrats when it comes to tax policy,” Berger said. “They would like to raise your taxes to fund a costly, big-government agenda. Senate Republicans would rather cut your taxes so you can keep more of your hard-earned money.”

If Senate Bill 651 passes, North Carolina’s personal income tax rate, which is already among the lowest in the Southeast, is set to decrease even more.

“When Republicans took majorities over a decade ago, Democrats had left us with a bloated tax system,” Rabon said. “Today, our tax system is competitive, lean, and allows us to continue making improvements that benefit all North Carolinians.”

Senate Bill 651 is part of a larger ongoing effort to reduce taxes in North Carolina. In recent years, Republican-led efforts have resulted in a series of tax cuts, including reductions in corporate income tax rates and changes to the state’s sales tax system. These changes have made North Carolina’s tax system more favorable for residents and businesses.

“Our tax policy has proven successful, and we are excited to build on that success,” Newton said. “We believe this tax package will return a significant amount of money to taxpayers while still maintaining the needed revenue to run the state smoothly.”