On Monday, North Carolina Senate leaders unveiled their proposed state budget. Governor Cooper will be under pressure to sign the final version because Medicaid expansion, a bill he signed earlier this year, is tied to passing a budget.

The Senate budget will cost $29.8 billion, a 10.5% increase from the previous budget and a number agreed upon in advance between the House and Senate.

“This is a strong budget that addresses our state’s needs without breaking the bank,” said Sen. Brent Jackson, R-Sampson, the Senate’s lead budget writer. “We increase spending where it is needed, bolster our reserves in light of economic uncertainty, and give money back to the hardworking people of North Carolina.”

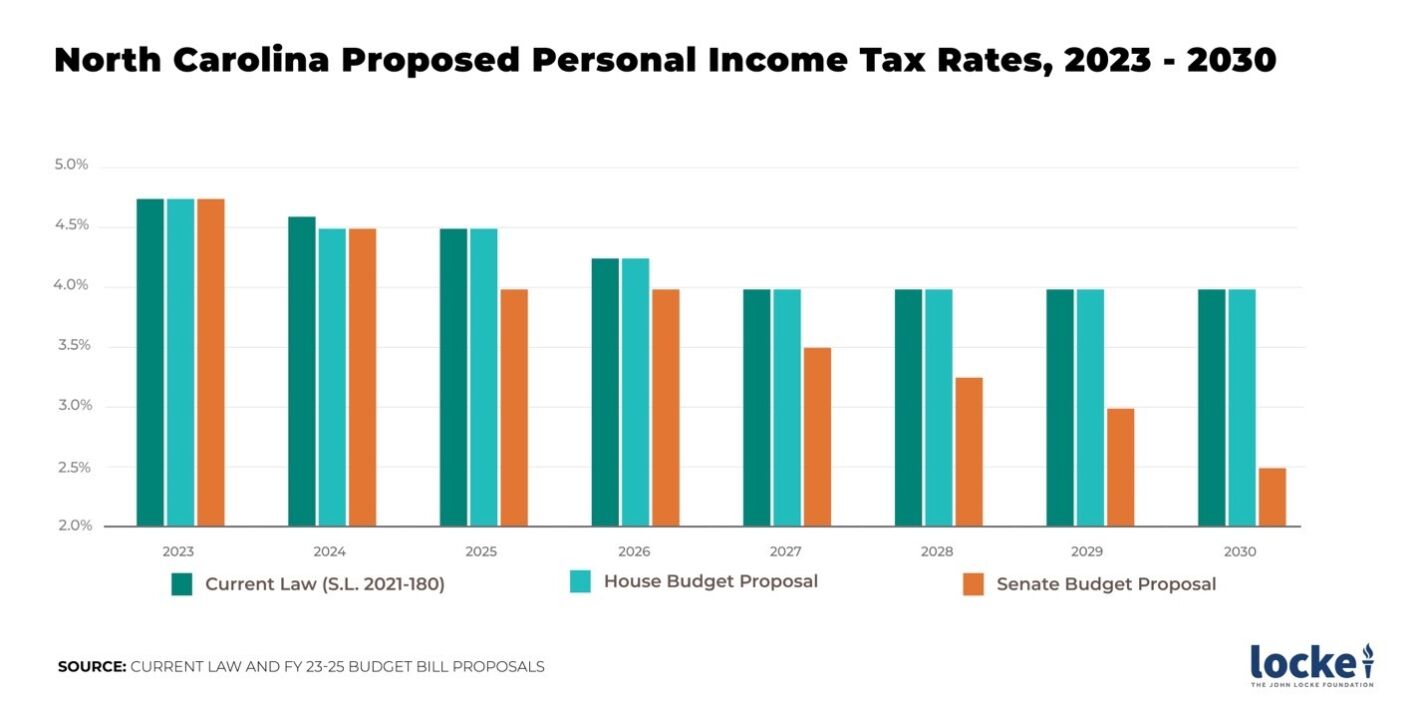

The Senate (in orange) indicated in its budget that it seeks to lower North Carolina’s personal income tax rate to 2.49% by 2030:

The Senate budget contained several differences from the House budget. The Senate did NOT include the following House policy provisions in their proposal:

- Make State Bureau of Investigation Independent Department: Insulates SBI from political interference, as recently uncovered by the outgoing SBI director, by making it completely isolated.

- Transfer State Crime Lab to Independent State Bureau of Investigation: The state crime lab would be transferred from the Department of Justice to be under the SBI.

- Prohibit Private Monetary Donations in Elections: Prevents the State Board of Elections, any county board of elections, and any county commissioners from accepting private monetary donations for conducting elections, including employing individuals on a temporary basis.

However, there were several similarities. Both House and Senate budgets contain the following policy provisions:

- Medical Freedom/COVID-19 Vaccinations: Discrimination against persons based on COVID-19 vaccination status would not be allowed.

- Remote Charter Schools: Enables the ability for charter schools to include or be solely based on remote enrollment/learning.

- Raise Mandatory Retirement Age for Appellate Judges: No justice or judge of the Supreme Court or Court of Appeals may continue in office beyond the last day of the month in which the justice or judge becomes 76 years old. However, they may apply to become an emergency justice via an express letter to the governor as long as they meet certain criteria.

- Prohibit Cap and Trade Requirements for Carbon Dioxide (CO2) emissions: No state agency, governor, or the Department of Environmental Quality, may require certain public utilities to engage in carbon offset programs.

- SBE/Prohibit ERIC Membership: Make it so that NC may not become a member of the Electronic Registration Information Center, Inc.

- Prohibition on State or Regional Emissions Standards for Motor Vehicles: Prohibits any requirements on controlling emissions on new motor vehicles.

- Limitations on State Funds for Abortions: Prevents state funds from being used in the performance or in support of the administration of an abortion unless certain exemption criteria are met, such as the mother’s life being in danger or the pregnancy being the result of rape.

What’s inside the senate budget:

Topline Figures

- Net appropriation for FY 2023-24 is $29.8 billion and net appropriation for FY 2024-25 is $30.9 billion.

- Almost doubles the Stabilization and Inflationary Reserve with an increase of $900 million for a total of $1.9 billion.

- Rainy Day Fund balance will be increased by $250 million for a total of $5 billion.

- Total of $6.6 billion in tax savings for North Carolinians over the next five years.

Taxes

- Cuts taxes by $1.2 billion for all North Carolina families and businesses over the next two years.

- Accelerates the scheduled reduction of the personal income tax, dropping it to 4.5% in 2024 and ultimately to 2.49% by 2030.

- Total of $6.6 billion in tax savings for North Carolinians over the next five years.

Education

- Spends over $17.2 billion on education in FY 2023-24 and over $17.6 billion in FY 2024-25.

- Expands the Opportunity Scholarship Program to all families.

- Increases funding for Opportunity Scholarship Grant Fund Reserve by $105 million in FY 2023-24 and $163 million in FY 2024-25.

- Creates a new School Health Personnel Allotment and increases funding by $10 million recurring to help public K-12 schools hire around 120 more nurses, counselors, social workers, and psychologists.

- Provides almost $70 million to develop and expand community college courses in high-demand career fields, including nursing and other health-related programs.

- Supports North Carolina A&T in its efforts to become the first HBCU to obtain the R1 Carnegie Classification with an additional $10 million recurring each fiscal year and $5 million non-recurring in the first fiscal year.

Transportation

- Increases funding for the Strategic Transportation Investments Prioritization Program by $469.75 million in FY 2023-24 and $604.5 million in FY 2024-25 to help prioritize and fund large transportation projects across the state.

- Provides an additional $75.6 million for contract resurfacing.

- Spends over $400 million in each year on the replacement and preservation of bridges.

- Boosts funding for the General Maintenance Reserve used to help upkeep roads by over $311 million.

Salaries

- Appropriates $94 million into the Labor Market Adjustment Reserve (LMAR).

- Doubles the LMAR allocation to state agencies and community colleges to 2%.

- Provides the UNC System $15 million in LMAR funds.

- State employees will receive a 5% pay raise over the biennium.

- Teachers will receive an average raise of 4.5% over the biennium, and starting teacher pay will increase by nearly 11% over the same period.

- Average teacher pay will be $59,121 by the end of FY 2024-25, just under North Carolina’s median household income.

- Nursing faculty at community colleges and the UNC System will receive a minimum 10% salary increase.

- The State Highway Patrol, State Bureau of Investigation, and Alcohol Law Enforcement will get a 12% pay increase across the biennium.

- Creates a pay scale for Juvenile Justice employees that aligns with the structure of the correctional officer salary schedule.

Healthcare

- Enacts Medicaid expansion.

- Appropriates the $1.5 billion of non-recurring funds from the federal “sign-on” bonus for expanding Medicaid, including:

- $370 million for NC Care Initiative between ECU and UNC Health systems that will feature the construction of 3 regional health clinics and rightsizing existing parts of their health systems.

- $96 million for rural loan repayment incentive programs for primary care and behavioral health providers.

- $60 million for start-up costs and expansion of healthcare programs at community colleges.

- $20 million for UNC-Pembroke’s new healthcare-oriented programs.

- Significant Certificate of Need reform, including repealing the CON requirements for mobile MRI machines, linear accelerators, physician office-based vascular access for hemodialysis, and kidney disease treatment centers.

- Repeals CON for ambulatory surgical centers and facilities with MRI machines in counties with a population under 125,000 that do not have a hospital.

- Includes $110 million to increase behavioral health provider rates on a recurring basis.

- Allocates $60 million recurring each year for direct care worker wage increases.

- Provides $50 million recurring to permanently retain half of the COVID-19 rate enhancement for skilled nursing facilities.

- Increases Medicaid reimbursements for private duty nursing services from $45 per hour to $52 per hour.

- Provides $15 million in each year of the biennium for the Free and Charitable Clinics to provide care to low-income families and individuals across the state.

Other Items

- Allocates $1.4 billion, available for drawdown by NCInnovation, to improve applied research outputs at UNC System schools and to help commercialize the results of that research.

- Directs the Economic Development Partnership of North Carolina to expand its study of megasites to include sites with fewer than 1,000 acres.

- Provides $10 million in reserves to support local governments conduct their due diligence on the new megasites identified in the study funded last year, and making those sites shovel ready.

- Expands the post-election audit report to include a summary and detailed description of the results, and information on any items that could have affected the outcome of the election.

- Includes an additional $35 million for the school safety grant program.

- Increases funding for anonymous tip line which facilitates anonymous reporting of school safety threats.

- Gives NC Emergency Management an additional $2.5 million in recurring funds to hire new support staff and to continue developing statewide school safety programs.

- Includes $1 million for the N.C. National Guard to support the Joint Cybersecurity Response Force, which will partner with the National Guard and N.C. Emergency Management to combat cyber-attacks across the state.

- Provides almost $19 million for a new N.C. Agriculture Manufacturing and Processing Initiative to incentivize the development of food processing facilities across the state.

- Sets aside $20 million nonrecurring over the biennium for the N.C. Housing Trust Fund to provide housing for homeless veterans, victims of domestic violence, sexual assault, and human trafficking.

The Senate budget also contains a provision to make the president of the North Carolina Community Colleges system be confirmed by the General Assembly.

Both budgets include funding for UNC Chapel Hill’s new School of Civic Life and Leadership. However, the Senate budget would cut funding to the School of Government and the School of Law by $5 million each over the next two fiscal years.

The Senate budget does not contain funding to move UNC’s law school to a new location, although the House budget did contain significant funds to do so.

There has been some speculation as to whether new casinos and gambling laws would be included in the Senate budget. They were not. Additionally, the SAVE Act and Parent’s Bill of Rights were not included.

The Senate’s budget will be heard in committees on Tuesday, with anticipated votes on Wednesday and Thursday.

Once the Senate passes its budget, the House is expected to vote not to concur, which will set up the conference process between the two chambers. They will meet to negotiate differences before finalizing a budget to send to Governor Cooper.

Cooper is expected to sign the budget regardless of what goes into it because he signed a bill to expand Medicaid earlier this year, parts of which are contingent on passing a state budget.

The budget committee report can be viewed HERE, and the bill text of the budget can be viewed HERE.