Two distinct but almost textually identical bills banning ESG investment criteria have passed their respective legislative bodies, signaling the strong possibility that either bill becomes law.

The bills in question are Senate Bill 737 and House Bill 750 — both short titled Address ESG Factors — and so far both of them have passed their respective legislative bodies.

Both bills would essentially ban “environmental, social, and governance (ESG) criteria” as well as “economically targeted investments (ETI) requirements” from being used by state agencies and state pension plans.

On May 3rd, SB 737 cleared the Senate on party lines with a 30-20 vote and HB 750 passed the House with a vote of 76-41. Additionally, HB 750 was discussed by the Senate Commerce and Insurance committee Tuesday afternoon.

Outlawed uses of these ESG or ETI standards include using them to either screen potential investments or manage assets in state pension plans, as well as using them to hire, fire, or evaluate state employees.

“I believe it is incumbent on us as a State Legislature to codify that our pension and other assets will be invested with only the maximization and security of these assets in mind. This should not be a political issue,” Rep. Celeste Cairns, R-Carteret, sponsor of HB 750, told Carolina Journal.

“Political winds change and shift over time, and the security of our retirees’ futures should not be at the mercy of those winds,” he added.

NC follows suit of Anti-ESG legislation

All of this comes as the Biden administration is asking a federal judge to throw out a lawsuit against the Department of Labor over a rule that allows retirement plans to consider ESG factors when selecting investments.

Last December, current state treasurer and candidate for governor, Dale Folwell, called for the firing of BlackRock CEO Larry Fink in a statement, citing “Wacktivism” and loss of confidence due to ESG investing.

“Unfortunately, Mr. Fink’s political agenda has gotten in the way of his same fiduciary duty,” Folwell wrote in his statement. “A focus on ESG is not a focus on returns, and potentially could force us to violate our own fiduciary duty of loyalty.”

According to a study done by the Harvard Law School forum on corporate governance, as of March 2023, at least seven states have either enacted laws or adopted regulations that prohibit or discourage public entities from using ESG factors when investing state resources.

So far, however, only two states, Idaho and North Dakota, have passed anti-ESG laws. Other states like Arizona, Florida, Indiana, Kentucky, and Mississippi have only enacted policies or statements from either state treasurers or state attorneys general.

“The surge of anti-ESG measures poses significant legal, operational, reputational, political and financial concerns for funds, asset managers and companies that integrate ESG investment into their policies, procedures and disclosures,” the Harvard Law study stated.

Sen. Daniel, R-Burke, sponsor of SB 750, told CJ concerning the corporate embracement of ESG, that “Corporate America has set itself on a course where upholding ESG standards – which are often rooted in the hot-button social issues favored by liberals – is becoming a larger, more determining factor in decision-making.”

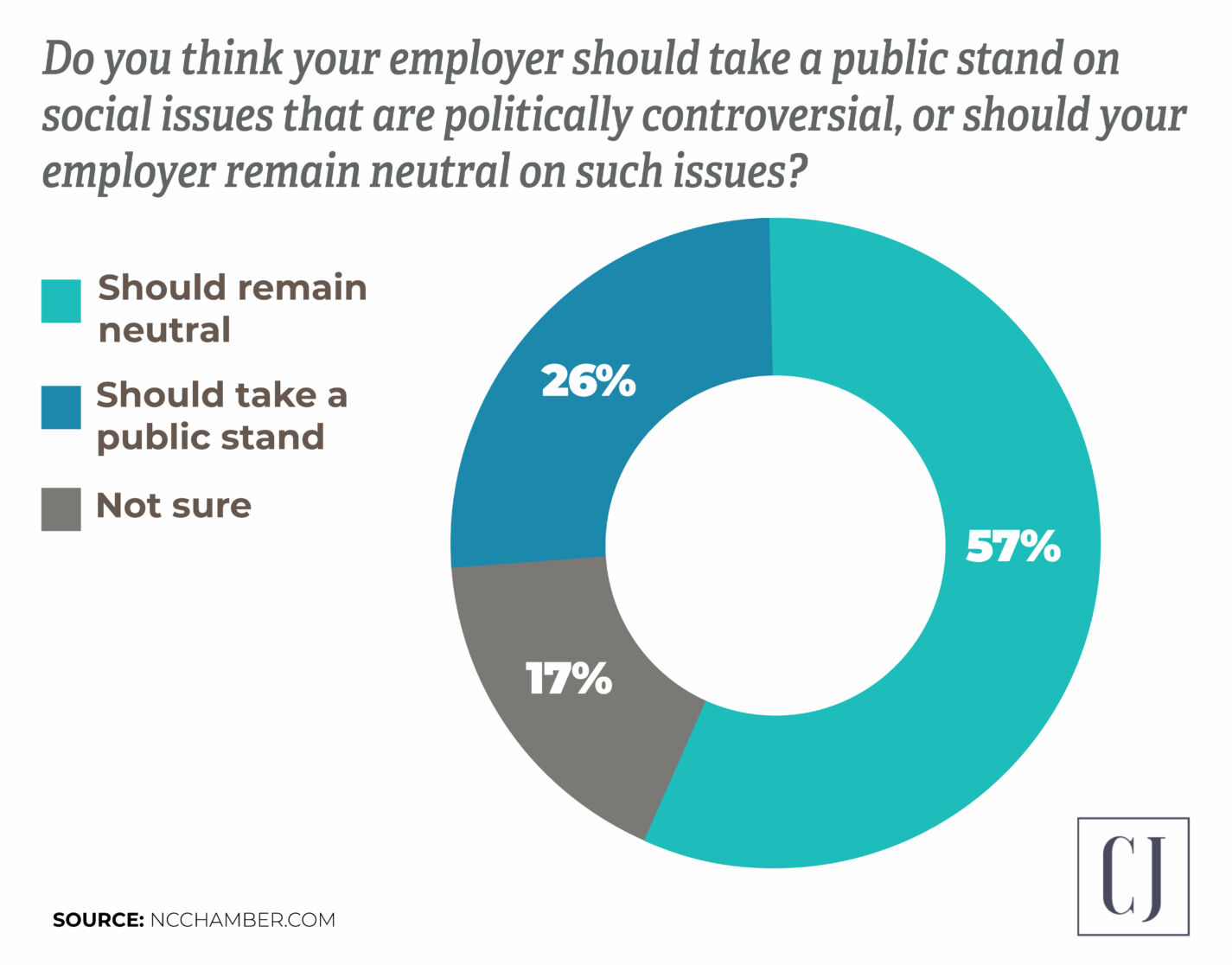

“It puts employees in a difficult and uncomfortable position when you consider that 57% of workers in North Carolina want their employers to remain neutral on social issues that are politically controversial,” he added, citing an NC employee satisfaction survey.

Environmental social and corporate governance (ESG)

Both SB 737 and HB 750 define ESG criteria as “ a set of standards to screen potential investments based upon the perceived impact to the environment and the social relationships between a company’s employees and the community.”

More comprehensively, ESG is a framework meant to capture “all the non-financial risks and opportunities inherent to a company’s day-to-day activities,” according to a report from accounting and consulting firm Deloitte. This means companies instituting this framework have to report their environmental, social, and governance impact. This in turn is meant to help investors make investment decisions based on ESG pillars, which include environmental, social, and governmental impact.

Broadly, the environmental pillar of ESG means reporting air, water, and ground pollution for companies. The social pillar refers to reporting how companies “manage their employee development and labour practices,” and the governance pillar refers to reporting shareholders rights and diversity, according to the Deloitte report.

Economically targeted investments (ETI)

Both SB 737 and HB 750 define economically targeted investments (ETI) requirements as ”a set of standards to screen potential investments based upon the perceived impact to the environment and the social relationships between a company’s employees and the community.” Additionally, both bills also designate requirements that grade “how a company’s leadership is structured” to fall under ETI requirements.

According to RBC Global Asset Management, a global investment management firm, ETIs are best categorized as a type of investment meant “to help meet the capital needs of underserved areas in an efficient and sustainable manner.”

HB 750 in Senate committee discussion

Sen. David Craven, R-Randolph, presented HB 750, during the Senate Commerce and Insurance committee Tuesday.

Sen. Natasha Marcus, D-Mecklenburg, said that it was in her understanding that the business community opposes this bill.

“If we don’t also recognize that issues such as climate change and social justice, even things like product recall issues, energy transition, and security are relevant to company’s long term financial health,” Marcus said.

Sen. Gladys Robinson, D-Guilford, also questioned why ETI was included in HB 750, and whether it was an effort to stop investment in companies led by women or minorities.

Craven responded to Robinson by clarifying the ETI portion of the bill was added as a preemptive measure and that the bill only affected government entities.

“All this bill does is ensure that there is no discrimination out there against anything within our employee pension funds,” Craven stated.

Sen. Marcus asked whether state pension fund investments could take into account issues like energy transition and security

“Yes, but only when you are pursuing it for the highest rate of return,” Craven said. “This bill does not prohibit you from doing that with an ESG fund.”

Senate Bill 737 now sits in the House Rules Committee for consideration and House Bill 750 has been referred to the Committee on Pensions, Retirement and Aging.