North Carolina’s low tax rates may have a lot to do with newcomers choosing North Carolina, especially for high-income earners. The state continues to see an influx of inward migration, even amid a housing affordability crisis, as the Carolina Journal previously reported.

“Importantly, recent evidence from the academic literature suggests that the link between state income taxes and decisions regarding where to live and work may indeed be strong,” reads a report from the Tax Foundation. “Taxes do affect migration and nonresident labor supply, factors policymakers need to consider when implementing tax changes.”

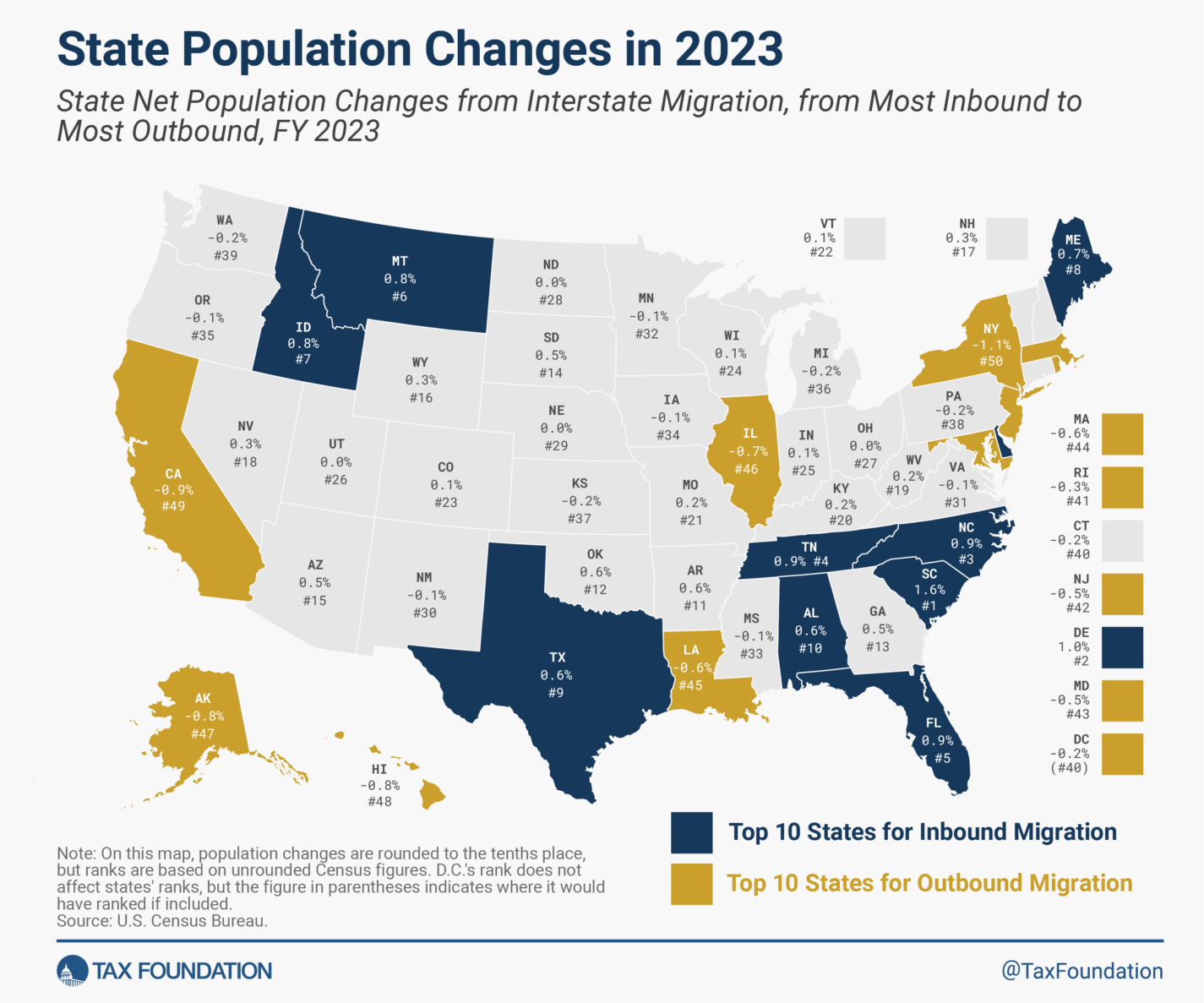

With a net population growth of 0.9%, North Carolina is only beaten out by our sister state, South Carolina, and Delaware, at 1.6% and 1.0%, respectively.

“The data shows that North Carolina gained 97,264 new residents on net from other U.S. states between July 1, 2022, and July 1, 2023,” Katherine Loughead, senior policy analyst and research manager at the Tax Foundation told the Carolina Journal in an email. “Since North Carolina’s estimated population on July 1, 2022, was 10,695,965 we estimate that North Carolina saw 0.91 percent population growth specifically attributable to interstate migration in FY 2023.”

High-income earners of $200,000 or more are particularly sensitive to tax increases, causing international and domestic migration. Since the high-income earners create a significant amount of tax revenue, for both federal and state coffers, their responses are important.

“Low- and middle-income individuals probably wouldn’t move just because of taxes,” Andrey Yushkov, senior policy analyst for the Tax Foundation, told the Carolina Journal during an interview. “In any given state, people who earn a median income of $60-$70k a year probably don’t pay enough in taxes, even in California or New York, to be able to move just because of taxes. But people who earn millions in any given year are more likely to relocate because of taxes. I would say that, obviously, it would be a mistake to think that everybody moves just because of taxes. It’s especially not true for low and middle-income households. But for high earners, research and data show that it is a very important factor.”

North Carolina ranks No. 9 on the Tax Foundation’s 2024 State Business Tax Climate Index.

“The absence of a major tax is a common factor among many of the top 10 states,” reported the Tax Foundation. “Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate income tax, the individual income tax, or the sales tax.”

Before January, North Carolina had a flat individual income tax rate of 4.75%. On January 1 of this year, the rate dropped to 4.50%, in accordance with HB 259.

“Essentially, North Carolina only loses taxpayers and adjusted gross income to its biggest competitor, South Carolina,” continued Yushkov. “The top marginal income tax rate in South Carolina is higher than in North Carolina because, again, in North Carolina, it is 4.5%. In South Carolina, it is 6.3%, starting from this year. So, it’s higher in [South Carolina], and probably those people who move from North Carolina to South Carolina don’t move because of taxes, especially affluent individuals. If you look at this comparison between North Carolina and South Carolina, taxes are not what drives this net outflow from NC.”

According to the Tax Foundation data, North Carolina ranks No. 27 in the nation for average sales tax, with an average sales tax rate of approximately 7%; No. 35 for the state income tax of 4.75% (at the time of ranking); and, the average local tax is 2.246%, according to a recent report from the Tax Foundation. North Carolina’s corporate tax rate currently stands at 2.5%.

It’s not just people, but businesses moving to the state as well. When it comes to online businesses, taxes are still a factor.

“Economic Nexus rules require that marketplace facilitators and remote sellers collect and remit sales taxes even when they do not have a physical presence in the state but meet certain thresholds,” Manish Bhatt, senior policy analyst for the Tax Foundation, told the Carolina Journal. “The idea being that you’re doing enough business in the state that you should be required, as a seller of goods and sometimes services, to collect and remit sales taxes on those transactions.”

In North Carolina, the economic nexus is either a sales dollar threshold or specific number of sales transactions.

“North Carolina has such a rule, which says if you exceed $100,000 in gross sales or 200 or more separate transactions, then you’re required to collect and remit the state’s sales taxes,” continued Bhatt. “The operative word here is “or” so, if you meet the monetary threshold, then obviously you’re required to collect and remit sales taxes. It is more problematic, however, when a marketplace facilitator or remote seller only meets the transactions threshold, as the cost to comply could be greater than the profits earned in the state.”

Overall, North Carolina’s tax environment for people and businesses seems to be, at least, a contributing factor to the high rate or inbound migration.

“The research on state migration has been pretty clear: high tax states like California and New York have been among the states losing population at the highest rate for years, while low-tax states like Texas, Florida, and now North Carolina are among the biggest gainers,” Brian Balfour, VP of Research at the John Locke Foundation told the Carolina Journal in an email. “Specifically, high-income earners can be especially sensitive to state tax rates. They are not stationary targets and have more resources to enable them to move more readily if a state imposes exorbitant tax rates on them. But it’s not just the rich that migrate. Lower-tax states typically enjoy greater economic and job growth, attracting more middle-and working class people as well.”

This trend of migrating due to tax or any other policy embodies the concept of “voting with your feet.”

“Foot voting under federalism can work even more effectively when state and local governments have incentives to compete for residents by offering lower taxes, cheaper housing, and better public services,” wrote Ilya Somin in National Affairs. “We can incentivize this competition by limiting federal subsidies to states and localities such that they are forced to rely as much as possible on revenue raised from their own taxpayers. In turn, this result would create stronger incentives for state and local governments to make policy decisions that attract new taxpayers and persuade current ones to stay put.”

State lawmakers also point to what they consider the obvious advantages of a low tax environment, and their work on reforming North Carolina’s tax code, as a boon to growth.

“There’s no question the low-tax agenda implemented by the Republican-led legislature has made North Carolina a more attractive state to live and work in,” Republican Sen. Phil Berger told the Carolina Journal in an email. “If you compare what Republicans have done here with the tax-and-spend policies of blue states, it’s clear our conservative tax policies are better for working families. We will continue to explore options for additional tax relief.”