Despite a housing affordability crisis, people are moving to North Carolina faster than almost every other state. While the Tar Heel State’s job sector is keeping up with a fast-growing population, the housing market is another story. Zoning laws and federal regulations are some of the biggest obstacles to overcoming the housing crisis in North Carolina and nationwide.

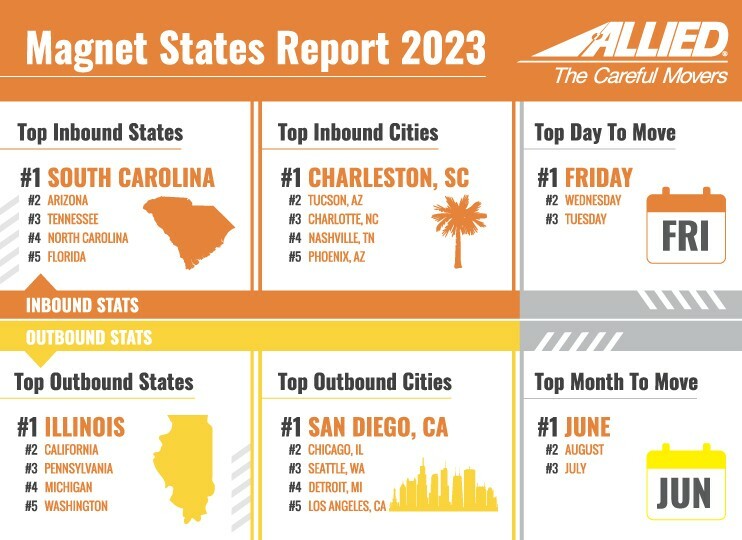

North Carolina is the No. 4 state in the nation for inbound migration and Charlotte is the No. 3 city in the US for inbound migrants. In 2023, North Carolina migration was inbound at 59.8% and outbound at 40.2%, according to the 2023 Allied US Migration Report. South Carolina claimed the top spot in that study.

The study identified factors contributing to the migration rate like rising home prices, increased rental prices, housing market dynamics, inflation and household wealth, and national median home prices. Despite the high level of inbound migration, North Carolina experiences several of these contributing factors.

Recently, North Carolina Insurance Commissioner Mike Causey rejected a request by the North Carolina Insurance Rate Bureau to raise homeowners insurance premiums by an average of 42%.

“The U.S. has a shortage of 7.3 million rental homes affordable and available to renters with extremely low incomes – that is, incomes at or below either the federal poverty guideline or 30% of their area median income, whichever is greater,” according to the 2023 report by the National Low Income Housing Coalition. “Only 33 affordable and available rental homes exist for every 100 extremely low-income renter households. Extremely low-income renters face a shortage in every state and major metropolitan area.”

Their report found affordable available units in North Carolina at or below extremely low income was -207,837. In the Charlotte-Concord-Gastonia Metro area, it was -49,395; in the Raleigh-Cary area, it was -34,025. For average median income (AMI), the total was -192,122. In the Charlotte-Concord-Gastonia Metro area, it was -44,000; in Raleigh-Cary, it was -23,567.

when will housing prices come down?

According to JP Morgan Chase, housing affordability won’t return to Charlotte until the second quarter of 2028, assuming no change in the mortgage rate, or by the fourth quarter of 2026, assuming a 1% drop in mortgage rates.

“U.S. home prices are currently at all-time highs, and less affordable (relative to income and mortgage rates) than at the height of the 2006 housing bubble. That’s after prices skyrocketed by about 40% during the pandemic,” according to a recent report by JP Morgan Chase.

In North Carolina, while the demand for housing is increased, new home growth is stagnant or below potential. Housing costs in North Carolina are still below nationwide averages as the price of buying a home has skyrocketed across the nation. Though new housing keeps in step with net job growth, retirees moving to North Carolina may contribute to unmet demand and rapidly rising prices, says a 2022 John Locke Foundation report on the housing problem.

Mandatory local, state, and federal housing policies force new home builders to designate some of their homes at below-market prices. This discourages new home builds, limiting the market supply and increasing prices. When homebuilders take a loss on new builds, they raise prices on existing units, forcing new buyers and renters to take the financial hit. According to the report, restrictions are also placed on accessory dwelling units (ADUs).

“New housing units are in high demand, yet restrictive zoning regulations worsen housing affordability by artificially limiting the housing supply. Consumer demand and preferences should be directing housing markets, not local governments,” the report found.

The federal government is putting tax dollars toward the issue. In 2022 North Carolina had $19.7 million dollars allocated in a Housing Trust Fund set up by the federal Department of Housing and Urban Development (HUD). The program is designed to “preserve and increase the number of affordable rental units available to extremely low-income households. Under this program, HUD provides funding to states for affordable housing rental projects.”

what do the candidates say?

Ahead of the March 5 primary, candidates are talking about these “kitchen table” economic issues like housing affordability, inflation, and the cost of childcare on the campaign trail.

“The best, simplest, and most efficient way to solve several problems at one time is to increase the pre-tax credit that people can deduct out of their paychecks to pay for childcare,” said, State Treasurer Dale Folwell, who is running for governor, in a WUNC 91.5 report. He added that such a program would include “the responsibility to educate people, especially middle-, lower- and fixed-income individuals, about how this saves them money in the long run.”

The campaign of Attorney General Josh Stein, also a gubernatorial candidate, focuses more on using taxpayer-paid incentive programs.

“As governor, he will work to expand the full range of housing options across the state so that a home is a source of stability, not stress,” Kate Frauenfelder, spokeswoman for Stein told WUNC. “That means using incentives from the North Carolina Housing Finance Agency to increase workforce homeownership, expanding the supply of affordable rental housing, and reducing homelessness.”

state legislature’s regulatory sandbox

In 2021, the General Assembly created the North Carolina Regulatory Sandbox to experiment with regulatory freedom for financial and insurance services. One of the John Locke Foundation’s top recommendations for addressing the housing crisis is to expand the “regulatory sandbox” to all industries.

“Overregulation, outdated legal restrictions, and the uncertainty of the risk environment from future laws and regulations can discourage entrepreneurial risk-taking and therefore prevent many new ideas from even getting a chance,” said Jon Sanders, director of the Center for Food, Power, and Life at the John Lock Foundation, in his recent study. “Consumers and service providers are left worse off for no other reason than being stuck in an unwieldy regulatory regime.”

The North Carolina Innovation Council implements the North Carolina Regulatory Sandbox.

“There is undoubtedly an opportunity to allow creative, market-driven solutions like ADUs to provide a greater range of housing options to North Carolinians, especially marginal renters in metro areas,” according to the Locke report. “Local leaders in North Carolina should remove barriers to housing that drive up prices and restore property owners’ rights to earn from their investments. North Carolina can be an example of expanding opportunity for all,”