North Carolina State Treasurer Dale Folwell is warning of a potential financial crisis for retiree healthcare provided by local governments across the state.

In a press release, he points out counties and municipalities have more than $7.6 billion in liabilities according to their annual audits.

Known as Other Post-Employment Benefits (OPEBs), these retiree supports primarily refer to health care but can include other medical benefits such as dental care, vision, and life insurance. In addition to the $7.6 billion amassed by local governments, the state of North Carolina has incurred a $25 billion shortfall, which is down from $34 billion.

“In 2017, I inherited one of the most bankrupt state health plans in the US,” Folwell said in an emailed statement to Carolina Journal. “It was only 2% funded.”

Folwell said the liability was created because “promises were made to state employees to be eligible for lifetime healthcare after 5 years of service, but no money was put aside for 45 years.”

He said they were able to bring down that number by negotiating a retiree insurance plan that has no cost to members and saves $1 billion for taxpayers, a pharmacy plan that saves $800 million, and administrative expense reductions of over $120 million.

“Unfortunately, the greedy non-profit hospital cartel rejected our offer to pay them a hundred percent profit which would have cut the liability in half over the long term.”

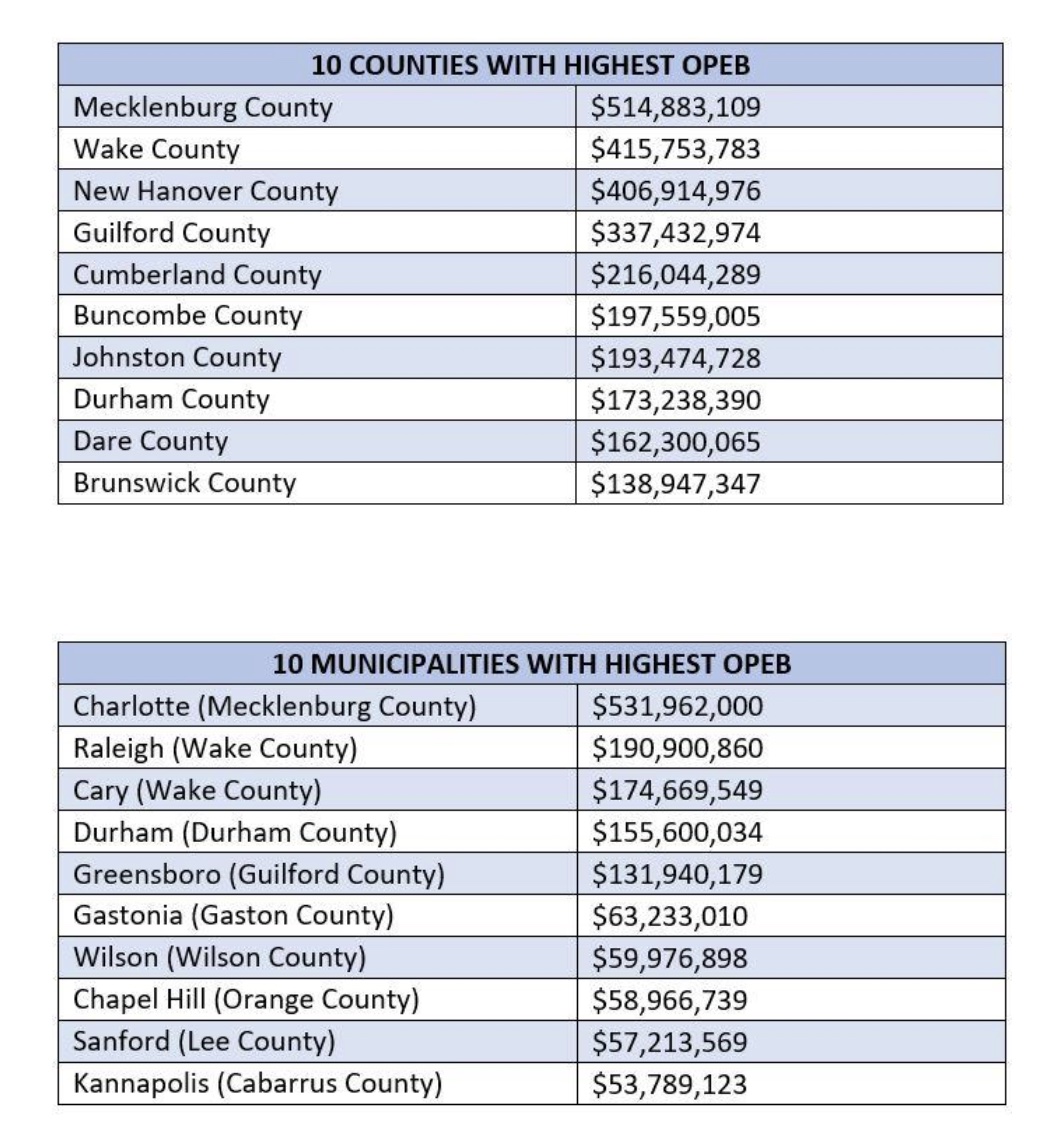

Folwell cited an April 2022 report that showed the median OPEB liability among towns and counties is just over $5.2 million. However, 59 counties and 41 municipalities have OPEB unfunded liabilities of $10 million or more. Another 185 have OPEB liabilities below $10 million. Charlotte has an almost $532 million unfunded OPEB liability, and Mecklenburg County has an OPEB liability close to $515 million. Raleigh has a $190.9 million OPEB unfunded liability, and Wake County’s OPEB liabilities total $415.7 million.

“Those are jarring numbers to be sure,” Folwell said. “For far too many years, local governments typically budgeted on a pay-as-they-go basis, covering only today’s costs with no plan for the future expenses. That is a risky, kick-the-can-down-the-road approach.”

However, he said that some agencies and municipalities are doing well.

The Raleigh Housing Authority, for example, is funded at greater than 100%. Winston-Salem’s OPEB liability of $72 million is funded at 89%.

By contrast, Winston-Salem is the only city among the state’s top 10 population centers whose OPEB liability is more than 25% funded. Four of those municipalities have a 0% funded rate. Of the top 10 counties by population, only Union (43%) and Forsyth (31%) are above 5% funded. Six were not funded at all.

The report also shows that 23 out of 287 local government units providing OPEB have set aside assets in a legally binding trust to begin cutting down their long-range shortfalls. .

Folwell said if a local government provides options for retirees to remain on its health plan, it might pay all of a retiree’s premium or a subsidy. With projected life expectancies increasing, local governments face increased OPEB costs for longer than originally predicted.

He also said local governments can offer retirees the option to buy into their health care plan at full cost, but because older retiree populations experience more and more costly health care treatments than younger employees, adding them to the insurance pool can hike costs.

Folwell noted figures from the Peterson-Kaiser Family Foundation Health System Tracker show that the price of medical care has grown 110.3% since 2000.

“Local governments need to appreciate that budgeting for current OPEB expenses is not the same as meeting long-term requirements,” Folwell said. “There is no time like the present to begin tackling this problem to ensure that promises made to public servants are fulfilled when those employees reach their post-employment years.”

He said one way local governments are taking steps to control costs is to end health insurance participation when a retiree becomes eligible to shift to Medicare coverage. Others have ended the benefit for new employees so their liability eventually will start to drop.

Folwell says local governments can shrink their OPEB liabilities by dedicating those savings to their OPEB trust funds.