In a Tuesday evening press conference at the NC General Assembly, Senate Leader Phil Berger, R-Rockingham, and House Speaker Tim Moore, R-Cleveland, announced an agreement to abandon, for now, efforts to legalize casinos through the state budget.

Focusing on tax cuts and development projects in the over $30 billion budget, the leaders announced that the Senate will vote on the conference report at 2:00 PM Thursday with final votes at 9:30 AM Friday. The House is planning to hold budget votes on the floor on Wednesday and Thursday.

“Medicaid expansion will still be contingent on the budget becoming law,” Berger told reporters. “The conference budget will not include VLTs for the rural tourism districts. We think this is the best, most prudent way for us to move forward.”

“A lot of the conversation has been about where the differences of opinion are, but now is a good time to talk about what a good budget this is, what it does,” said Moore. “Absolutely record investment in rural infrastructure like water sewer and education, tax relief for working families, more money for education, pay raises for our hard working state employees — we have probably the greatest budget I’ve ever seen.”

Berger did tell reporters that the casino issue is not dead, though. Leadership plans to bring it back up in a later session for more discussion.

Senate Leader Phil Berger originally wanted to include casinos in the state budget. However, the House never garnered the support necessary to get a budget with casinos over the finish line, with only 42 of his Republican colleagues expressing a willingness to do so. After a new plan was floated that would have paired Medicaid expansion with casinos through House Bill 149, most Democrats indicated they would likely vote against it.

Berger pointed to high “emotions” from certain lawmakers as the reason for the change.

Medicaid expansion is still tied to passing the budget. However, now that casinos are not in the budget, legislative leaders are nearing a final agreement, and Democrat Gov. Roy Cooper is now more likely than not to sign the budget. Moore and Berger both said they expect the budget to pass with at least supermajority margins and bipartisan support.

Here’s what was inside the leaked draft, which legislative leaders have confirmed is very close to the final agreement:

taxes

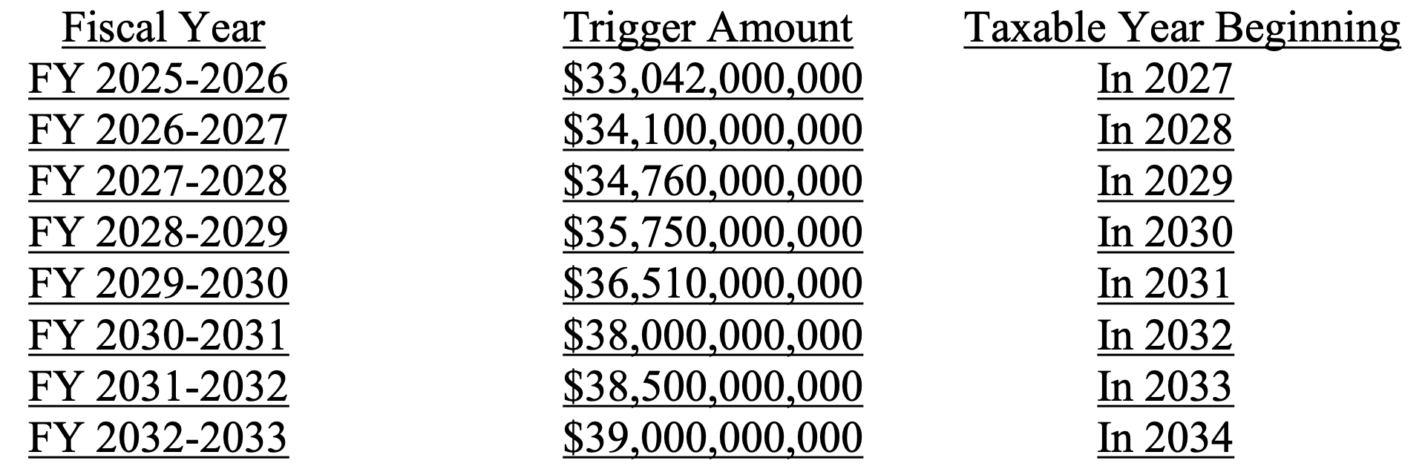

Personal income tax drops to 2.49%: North Carolinians’ personal income tax could drop to as low as 2.49% in the next five years, but only if revenue triggers are hit each year. There will be a 0.50% PIT reduction each FY revenue triggers are hit.

If there are years where North Carolina does not hit revenue goals, the PIT rate will remain the same, but no PIT cuts will be reversed once they occur. The soonest PIT could drop to 2.49% would be 2029, on the condition of revenue hitting the “trigger amount” every year. With large-scale gambling revenue not kicking in until the Senate figures out how to get its desired casinos and VLTs, North Carolina is unlikely to hit all of the revenue triggers every year.

For reference, North Carolina revenue for the 2022-23 Fiscal Year was $33.535 billion.

Franchise tax capped: The franchise tax will be capped starting in 2025 and will affect corporate income tax filings starting in 2024. For “C” corporations, for the first $1 million of their tax base, they will pay a flat fee of $500. For any amount of their tax base that exceeds $1 million, they will pay $1.50 for every $1,000 of that excess amount. “S” corporations will pay $200 for the first $1 million of their tax base and $1.50 for every $1,000 of the excess amount. The budget sets minimum tax for all corporations at $200 and a maximum of $150,000.

Privilege tax repealed: The budget’s tax package includes a repeal of the privilege tax but keeps certain exceptions for financial and lending businesses.

Extends sales tax exemptions: Sales tax exemptions are extended from their previous expiration date from Jan 1, 2024, to 2028. These exemptions include retail sales and use taxes on motorsports, senior care facilities, aviation, fuel for freight boats, and breast pumps.

Vape tax: The budget allows for vape products containing nicotine to be taxed similarly to other products. They are also shifting the tax from being cost-based to weight-based.

Rideshare service tax: The General Assembly is implementing a new excise tax on Uber, Lyft, and other rideshare services of 1.5% for exclusive rides and 1% for shared rides.

Economic development initiatives

NCInnovation: Lawmakers have settled on giving NCInnovation $500 million, or $250 million a year for two years. It will still be set up as an endowment. NCInnovation is a private, non-profit corporation that focuses on facilitating the commercialization of research from North Carolina universities. This decision contrasts with the Senate’s earlier proposal of a $1.425 billion endowment, significantly diverging from the House’s $50 million allocation.

The budget also includes stipulations to cap salaries funded by NCInnovation at $140,000, introduces enhanced reporting requirements to the legislature’s Joint Government Operations Committee, and mandates reporting on outcomes, regional hub expenditures, unaudited overhead reports, and more. The State Auditor gains explicit audit authority, while the North Carolina General Assembly is granted the power to repeal NCInnovation’s charter and reclaim assets. Additionally, the budget outlines extensive functional and job description parameters for NCInnovation’s operations.

Regional Economic Development Reserve: The budget establishes a Regional Economic Development Reserve within the General Fund, allocating $1.25 billion in nonrecurring funds for the 2023-2024 fiscal year.

Golden LEAF: The budget increases Golden LEAF funding from $17 million annually to $25 million annually. Golden LEAF is a nonprofit that works “to increase economic opportunity in North Carolina’s rural and tobacco-dependent communities through leadership in grantmaking, collaboration, innovation, and stewardship as an independent and perpetual foundation,” according to its website.

education

Universal School Choice: Opportunity scholarships will be awarded to eligible students based on household income levels and the average state per pupil allocation. For reference below, North Carolina’s per pupil allotment as of 2022 is $7,426, and the income threshold for free and reduced lunch varies based on number of children in the household.

- Students from households with income levels qualifying for the federal free or reduced-price lunch program are eligible for a grant of up to 100% of the prior fiscal year’s average State per-pupil allocation.

- Students from households with income levels between 100% and 200% of the federal free or reduced-price lunch program are eligible for a grant of up to 90% of the prior fiscal year’s average state per-pupil allocation.

- Students from households with income levels between 200% and 450% of the federal free or reduced-price lunch program are eligible for a grant of up to 60% of the prior fiscal year’s average state per-pupil allocation.

- Students from households with income levels above 450% of the federal free or reduced-price lunch program are eligible for a grant of up to 45% of the prior fiscal year’s average state per-pupil allocation.

There will be an annual audit on 4% of opportunity scholarship recipients in order to verify North Carolina residency requirements are met. The General Assembly will also require opportunity scholarship school recipients to contract with a CPA to perform annual financial reviews.

Free lunch and breakfast for more low-income students: Mandates that the Department of Public Instruction expand public school participation in the federal Community Eligibility Provision (CEP) program to increase the number of students with access to healthy, cost-free school breakfast and lunch.

School safety: This budget allocates $3.2 million for New Hanover County and $2 million for Davidson County for an Artificial Intelligence school-safety pilot program.

Teacher pay raises: The budget gives teachers an average increase in pay of about 7% over the next two years. Increases in base salary are larger for early-in-career teachers than for more experienced teachers, with raises ranging from 3.6% to 10.8% depending on the number of years worked.

Bus drivers: Bus drivers will get an extra 2% more than most state employees, for a total of about a 9% raise over the next two years.

UNC School of Civic Life and Leadership: In Chapel Hill, the UNC School of Civic Life and Leadership will be established and will be run by the provost rather than being directly under the chancellor.

Infrastructure

Water and sewer: Nearly $2 billion is allocated to over 200 individual water and sewer related projects all across the state.

Highway Fund: For the Fiscal Year 2023-24, the budget allocates almost $3 billion. For 2024-25, the budget allocates almost $3.2 billion.

Prohibition on state or regional emissions standards for motor vehicles: Prohibits any requirements on controlling emissions on new motor vehicles and reduces the number of vehicles currently subject to emissions inspections.

Prohibit cap-and-trade requirements for carbon dioxide (CO2) emissions: No state agency, governor, or the Department of Environmental Quality, may require certain public utilities to engage in carbon-offset programs.

Concealed carry for judges: Judges will now be allowed to conceal weapons in a court room setting for self defense.

court/Justice system changes

Raise mandatory retirement age for appellate judges: No justice or judge of the Supreme Court or Court of Appeals may continue in office beyond the last day of the month in which the justice or judge becomes 76 years old. This raises the current ceiling of 72 and will allow Chief Justice Paul Newby to serve out his full term on the court.

New assistant district attorneys: There will be new assistant district attorney roles added to Wake, Cumberland, Mecklenburg, Randolph, Forsyth, Cherokee, Clay, Graham, Haywood, Jackson, Macon, and Swain Counties.

Pay raises for judges and court administrators: Similar to other state employees, judges and court administrators will receive pay raises over the next two years.

SBI receives increased independence: The State Bureau of Investigation is removed out from under the Department of Public Safety and made a “single, unified, cabinet-level department under the governor.” There is also language clarifying the SBI director’s authority in the organization.

Other policy measures

COVID-19 discrimination: This is a policy provision in the state budget that makes it so state agencies and governments cannot discriminate against someone on the basis of their COVID-19 vaccination status or willingness to show proof of vaccination, meaning COVID-19 vaccination cannot be mandated either. This primarily extends to public colleges and private colleges receiving state funds.

No local minimum wage: Local governments will not be allowed to set their own wage policies, including establishing a minimum wage or mandating companies provide benefits such as paid parental leave or vacation time. Local jurisdictions will also not be allowed to cap the number of hours employees can work weekly. The budget makes this explicit.

State Board of Community Colleges: The General Assembly gains 10 seats on the Board of Community Colleges, moving from eight to 18 members and stripping the governor of his appointment powers. It is unclear, based on the released budget draft, whether the board will consist of 19 or 22 seats.

SBE/prohibit ERIC membership: The budget prohibits North Carolina from becoming a member of the Electronic Registration Information Center, Inc.

Voter ID: The budget provides funding for voter ID implementation.

Lobbyist fees: Lobbyists will have the option to buy what people have called “fast passes” for $2,000 each session to not have to wait in security lines. Liaisons will be able to buy them for $1,000. Lobbyist registration fees are also being raised from $250 to $500 annually.

Study to privatize the DMV: In the budget, the General Assembly has commissioned a study to conduct an analysis as to whether the Department of Motor Vehicles could be privatized in an effort to “provide a more citizen-friendly service model for the taxpayers of the State.”

Editor’s note: This story will be updated with the official budget as soon as it is available.