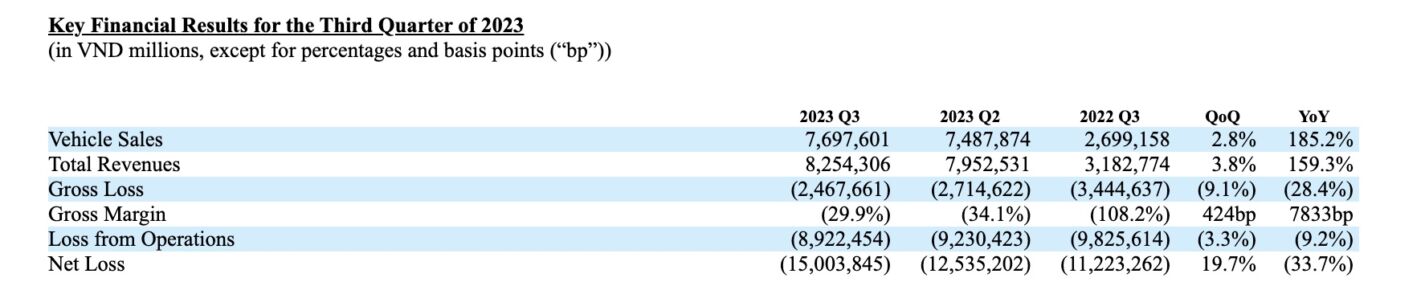

Coming on the heels of a second-quarter report that saw losses of $526.7 million, VinFast reported Thursday that it lost an additional $623 million for the third quarter of 2023. That brings total losses since 2021 for the Vietnamese electric vehicle maker to $5.1 billion.

The company plans on building a $4 billion EV manufacturing plant in Moncure, Chatham County, in 2025.

The company’s stock price also continues to fall, hovering around $8 per share this week on the Nasdaq, down from a peak of $80 per share.

Vehicle sales did rise slightly in Q3 at $319.5 million, up from 2.8% in Q2. There is no word, however, if any of those vehicles may have been sold to Vingroup, the owners of VinFast.

It was reported last month that the automaker had sold 11,300 vehicles during the first half of 2023, with more than half, 7,100, being bought by Green and Smart Mobility, a Vietnamese taxi company controlled by Vingroup.

VinFast’s revenue rose 3.8% quarter-over-quarter to $342.7 million, primarily from vehicle sales. The company also said it had $131 in cash and equivalents.

So, is the writing on the wall for the troubled automaker? And what about its plans to build in Triangle Innovation Point?

Many reports this week say that between the company’s continued staggering losses and a limited amount of revenue, it doesn’t give much leeway for the company.

Mike Walden, William Neal Reynolds distinguished professor emeritus of economics at NC State agrees that VinFast has its challenges.

“First, it is a new company to the US market, so once production begins, it will need to prove itself with sales,” Walden said in an emailed statement to Carolina Journal. “Second, higher costs for EVs are causing reduced net revenues for EV manufacturers — compared to gasoline-powered vehicles. VinFast will have to succeed against these two challenges, which creates uncertainty for investors.”

VinFast officials say they are optimistic about the future.

“We have inspirational and ambitious plans to build a greener future for everyone,” Madam Thuy Le, Global Chief Executive Officer of VinFast said in the company’s report. “The successes achieved in the past two quarters are just the first stepping stone. We have come up with a concrete action plan to deliver on each growth milestone and to accelerate our global expansion.”

David Mansfield, CEO, said they see strong momentum in their business, supported by growing delivery volumes, increased revenues, and an improved path to profitability.

“We are focused on our cost-cutting initiatives, optimizing return on capital invested, and switching towards a capital-light distribution model,” he said. “VinFast is on track to meet its deliveries guidance and is well-positioned to expand in strategic markets such as Indonesia and India. We received significant funding in the third quarter from Vingroup and Chairman Pham Nhat Vuong and will continue to look for opportunities to strengthen our strong balance sheet to support growth and achieve further success.”

Vuong had pledged to provide $2.5 billion to the company earlier this year through grants and loans, and the company said Thursday that it expects to receive $1.2 billion from its owner and major shareholders in the next six months.

The groundbreaking of the EV manufacturing plant in Triangle Innovation Point, Moncure, Chatham County, held July 28, is the company’s first entry into the US vehicle market (it will also be North Carolina’s first auto-manufacturing plant), but it won’t be VinFast’s last foray into building manufacturing plants outside of its native Vietnam.

The company has set its sights on expanding to other countries, including Indonesia, with the goal of building a plant there in 2026. The country is especially attractive given its high nickel composition, a key component of EV batteries.

Reports say the company plans to invest around $1.2 billion in the Indonesian market in the long term, of which $200 million would be reserved for the plant, according to its latest filing to the SEC.

The company said on Thursday that it had similar plans for India. They are banking on access to government incentives for manufacturing (similar to North Carolina), relief from certain tariffs and taxes, and access to raw materials at an attractive rate.

Production is expected to start in both countries by 2026.

In order to attract the newly formed company, North Carolina and Chatham County promised to spend nearly $1.2 billion in incentives over the next 32 years, provided that it reaches its hiring and investment goals.

In addition, VinFast said it is aiming to have its vehicles in up to 50 global markets and countries by the end of 2024. They also said they received applications or letters of intent from 27 dealers with more than 100 open points across 12 states, including North Carolina, Florida, Texas, Virginia, Louisiana, New Jersey, and Arkansas.