- Study: A single mother of two children who would require a 67% raise at an annual income of $32,000 in order to overcome losses in benefits from bringing in more income.

A joint legislative oversight committee heard from an expert on Thursday about the negatives of benefits cliffs.

Benefits cliffs occur when a small wage increase puts a family over the threshold to stop receiving public benefits. The wage increase isn’t sufficient to offset the loss of benefits, resulting in a net loss of income for the family, according to Brittany Birken, director of community and economic development at the Federal Reserve Bank of Atlanta.

Lawmakers are considering whether to pass a study bill on benefits cliffs and implementing a possible consolidation of welfare programs known as the “One Door” policy.

Birken relayed a story from Florida where a single mom with two young children who had been offered a 10-cent an hour raise. She said if her math was correct, she would lose her benefits through the childcare subsidy program.

“We confirmed her math. For that $200 a year increase, she was going to lose access to $9,000 in childcare subsidies,” Birken said. “The real dilemma that families can face is advancing in their career or making financial ends meet.”

The types of programs involved are means-tested government programs meant to alleviate poverty. Examples include food stamps, Medicaid, child-care subsidies, rental assistance for housing, and refundable tax credits like the Earned Income Tax Credit.

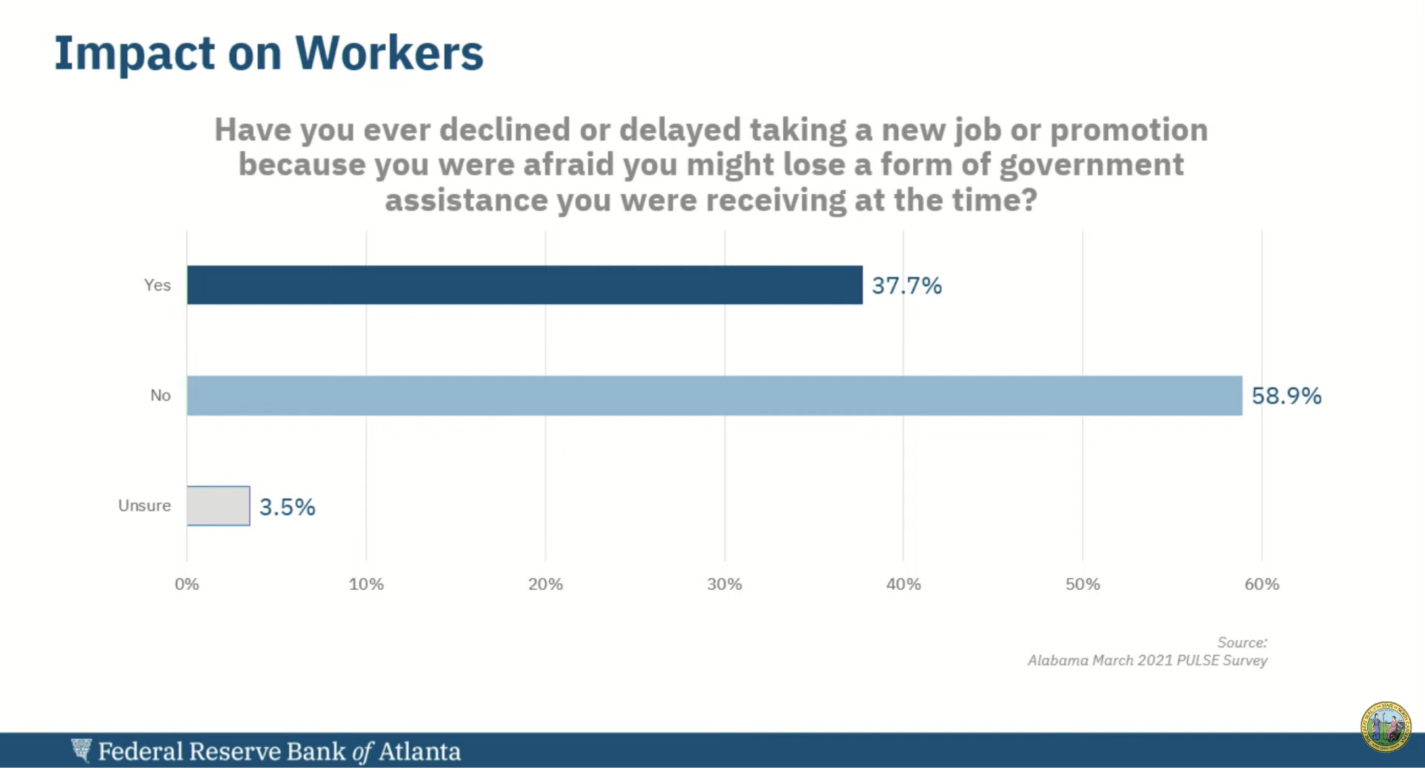

According to a 2021 pulse survey from Alabama, benefits cliffs are a major barrier for low-income workers. Asked if they had ever declined or delayed a new job or promotion due to losing public benefits, nearly 40% of the respondents said they had.

In one example Birken gave, a family would be no better off making $49,000 a year than they would be at $14,000 a year with public benefits included.

“We know that these short-term barriers may prevent the workers realization of long-term gains” said Birken. “So it could be in the financial interest of the family long term to continue advancing the careers, but the barriers, if it’s putting financials upside down, are going to make the family face challenges in climbing over those hurtles.”

Fixing benefits cliffs would also have benefits for broader society, Birken said. One example is a person moving from a minimum wage job to become a registered nurse. Over the lifetime of their career, there would be a savings to taxpayers of nearly $350,000.

“Imagine the multiplier effect if more families are able to move to self-sufficiency,” Birken said. “Ultimately, the net returns to the taxpayer can be significant as the worker advances.”

A recent report by the Georgia Center for Opportunity focused on the ways benefits cliffs in North Carolina discourage economic advancement. The study gave an example of a single mother of two children who would require a 67% raise at an annual income of $32,000 in order to overcome losses in benefits from bringing in more income.

“I’m seeing this everywhere, and it’s going to continue to happen until we put controls in place and hopefully come up with some new policy,” said Rep. Kanika Brown, D-Forsyth, during the committee meeting. She raised the possibility of giving people a window of time after receiving a pay raise before their public benefits phase out.

Birken said states can explore implementing transition periods for benefit losses to help families weather them better.