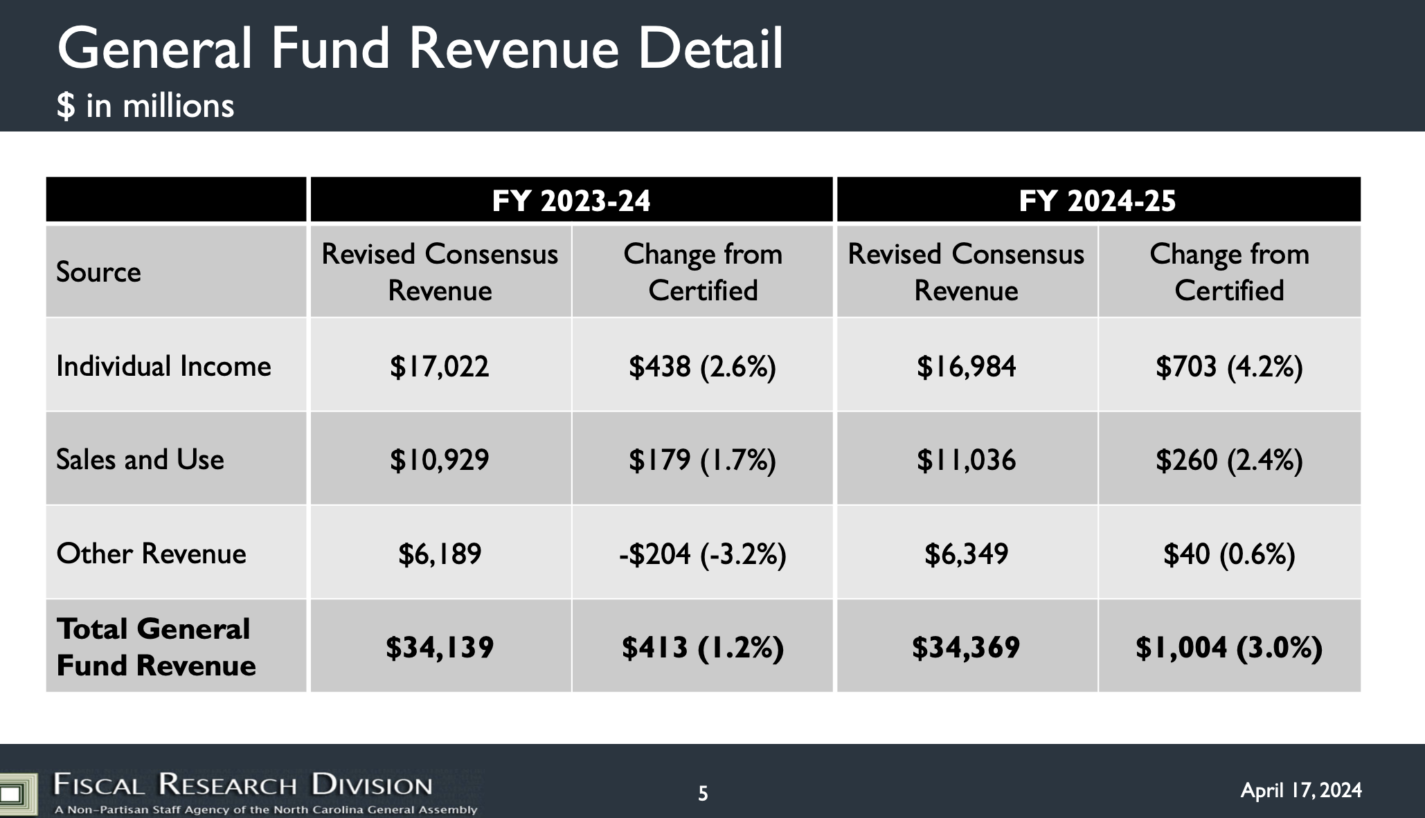

North Carolina Speaker of the House Tim Moore released information Thursday revealing the State of North Carolina projects a revenue surplus of well over a billion dollars for the fiscal year ending June 30. The projections include $400 million in collections above forecast in the current fiscal year, and what researchers estimate will be $1 billion additional revenue coming into the state coffers in FY 2024-25.

“Today’s revenue forecast is a sign that North Carolina is on the right track,” Moore said in a press release. “Our conservative approach to responsible spending has been effective in strengthening our economy and attracting business to our state. When those businesses bring thousands of jobs to NC and our economy is strong, all of North Carolina wins.”

The report from the North Carolina General Assembly’s Fiscal Research Division projects that, while inflation and interest rates are still up, the gross state product is up 6.7% with wages and salaries up 6.2% year-over-year in March of 2024.

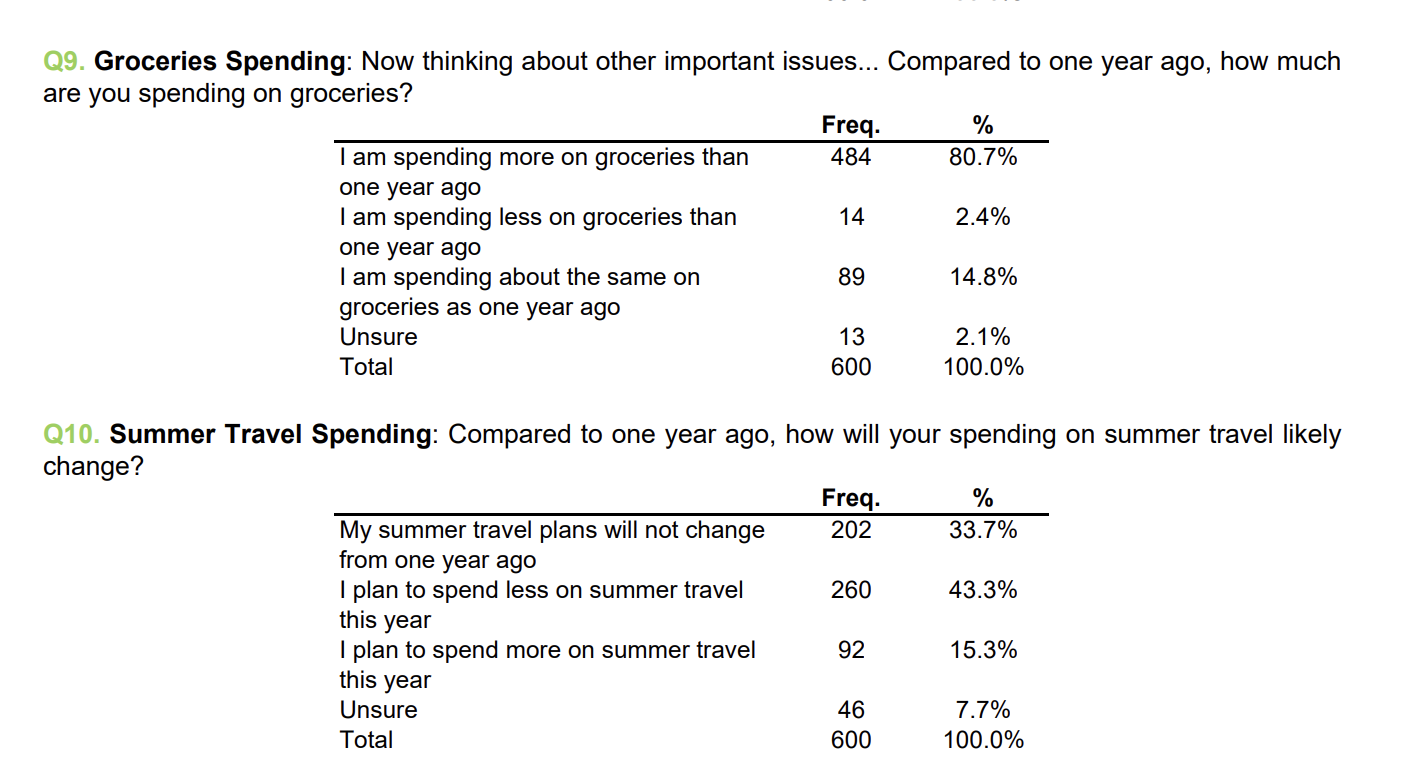

State economists had anticipated a decline in revenue, given rising prices and interest rates. They say a contributing factor to the buoyed revenue was increased sales tax collections associated with higher prices. However, they also warn the risk of continually high or increasing interest rates would pose a problem to the state’s economy as consumers remain concerned about rising costs of living. In Carolina Journal’s March poll, 80% of North Carolinians polled said they are spending more on groceries this year, and 43% said they plan to spend less on summer travel.

“The latest forecast update reflects North Carolina’s strong economic performance, thanks in no small part to the conservative tax reforms over the past decade that transformed North Carolina from one of the worst business tax climates in the nation to one of the best,” said Brian Balfour, Senior Vice President of Research at the John Locke Foundation.

In North Carolina, the state legislature has constitutional authority over the state budget. The move toward cutting taxes and cleaning up the state’s fiscal landscape started in 2011, after a Republican majority was elected to the state legislature for the first time in a century ushering in tax reform. The legislature’s focus on building a state rainy day fund means North Carolina now has a savings reserve of $4.75 billion. Prior to that, during the Great Recession, North Carolina faced a fiscal crisis with a multi-bracket tax that topped out at 7.75, budget deficits, and teacher furloughs.

This year’s short legislative session gears up next week and generally focuses on adjustments to the second of the two-year budget. Debate over what to do with the surplus is starting already as some call for more spending on K-12 public schools. The current $29.7 billion General Fund budget authorizes nearly 40% of the state budget to K-12 schools, and 58% for K-12, universities and community colleges combined. Over the current two year budget, it amounts to a $795 million increase for K-12 public schools.

“The additional revenue runs contrary to the recurring predictions of massive budget shortfalls made by progressives due to the tax cuts,” said Balfour. “This also bolsters the case for legislators to fully fund the opportunity scholarship expansion, and to look for further tax reforms such as eliminating the franchise tax.”

The legislative short session is slated to gavel in on Wednesday April 24.