North Carolina General Assembly lawmakers from the House and Senate met Tuesday to dig into why the state has $3.25 billion in excess revenue for the 2022-23 biennium. The revenue forecast was released last week by the Fiscal Research Division and the Office of State Budget and Management (O.S.B.M.).

Emma Turner, PhD., who leads the General Assembly’s fiscal research department, told members of the joint Committee on Appropriations/Base Budget that there are four reasons for the excess revenue:

- Changes to economic outlook, including inflation and interest rates

- State tax collections up to this point in the year were higher than forecasted

- More people realized capital gains than expected this year

- Changes to tax policy

The complete slideshow Turner presented to the committee can be found here.

Changes to economic outlook

Inflation has continued longer and at higher rates than expected, which has led to higher sales tax collections. Consumer spending also held up better than anticipated. The Federal Reserve is expected to raise interest rates and bring the top rate to 5%, according to Turner. She expects rates to remain high until 2024.

Higher tax collections so far in 2023

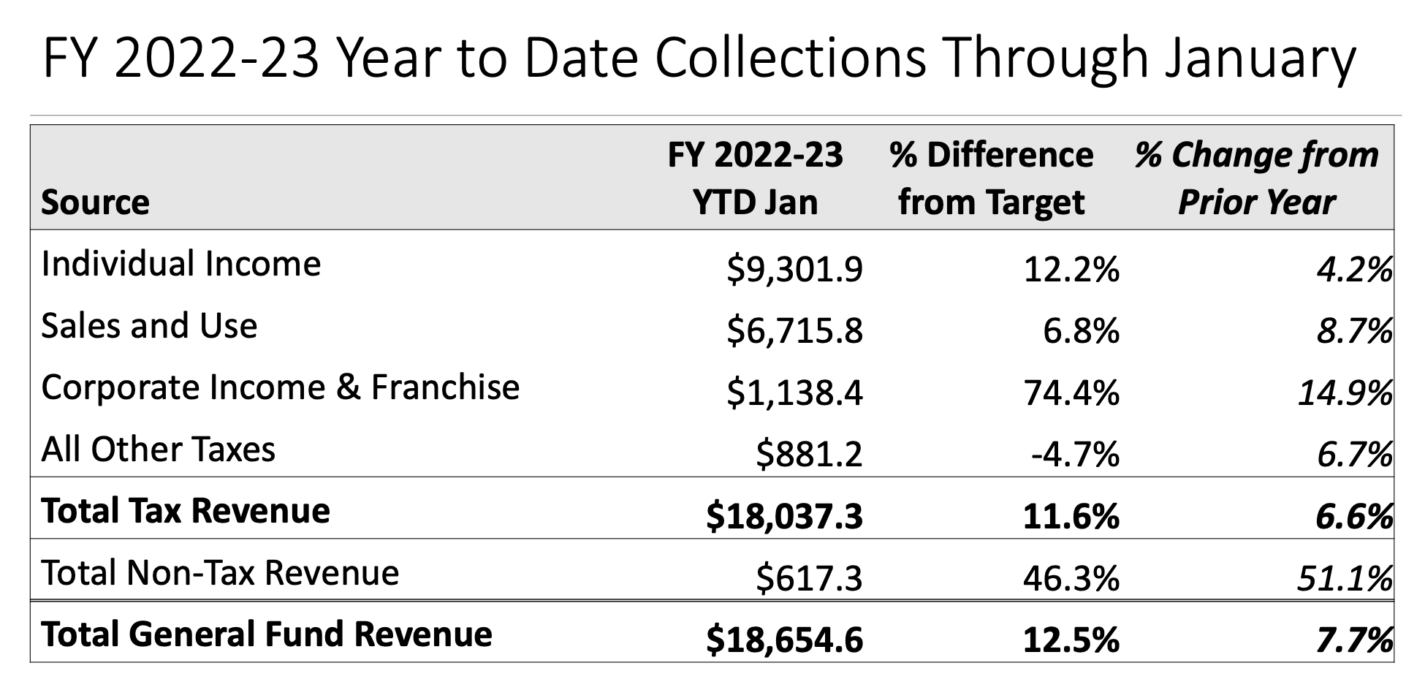

More individual income, sales and use, corporate income and franchise taxes have been collected this year than previously forecasted. Non-tax revenue, although a smaller portion of the state’s income, was also up significantly.

Changes to Tax Policy

Last year, the Republican-led General Assembly increased the standard deduction for state income tax and increased child and medical deductions. The state also made a few changes to the franchise tax, eliminating two property bases.

While several factors led to the state having $3.25 billion more revenue than expected, chief amongst them is more robust consumer spending, higher inflation, and more state investment growth due to higher interest rates.

The Fiscal Research Department’s report states that nontax revenue from investment income is expected to be more than 10 times higher this year due to higher interest rates. Notably, treasurer investments are up more than 2000%, bringing in $216 million more than last year at this time.

The report also predicts inflation will slow down over the next two years, as will consumer spending. They referred to our current economic outlook as a “Slowcession,” which differs from a recession in that economic growth is not currently negative. Employment is expected to remain “flat” in 2023 and “rebound slightly” in 2024, while wages will likely grow slightly because of inflation.

Researchers do not expect a significant increase in unemployment, and say they are still gauging the net impact of inflation on the overall state budget.